By David R. Guttery, RFC, RFS, CAM

President, Keystone Financial Group-Trussville Al

Don’t be a lemming!

Thirty three years ago, my finance 412 professor put that brain fold into my mind. He would engage the class by posing scenarios and then randomly selecting students to opine with their thoughts. One particular day, as I was half way through my response, he extended his hand and interrupted me mid-sentence with “Don’t be a lemming Mr. Guttery”.

In case you didn’t already know, a lemming is a furry brown rodent. They tend to live in very large, concentrated communities, and they migrate as do many other species of animals. In the 17th century, naturalist studies in Norway concluded that migratory patterns were often sparked by disruption, or fear. Many studies recorded herds of these lemmings reaching a water impediment, into which they would dive and attempt to cross. The problem is that lemmings aren’t the best of swimmers, and many in the herd died from drowning.

This is the nexus behind the phrase, “don’t be a lemming”. It’s a metaphor for human behavior. Very often, herd mentality when investing, driven by fear, panic, and speculation can result in actions that are shall we say, less than healthy. I love this Far Side cartoon, and I refer to it during periods of market and economic distress. See the lemming in the upper right corner with the floaty ring around his waist? Be that guy.

Seriously, we as investors must truly be mindful of not only the palpable sentiment that I described within my last article, but furthermore, we must be aware of how such inspires and impacts our behavior.

Resisting Herd Mentality When Investing

Don’t be a lemming can also be a metaphor for thinking outside of the box. Resist the temptation to buy into the herd mentality of the day, and think outside of the box. I help my clients with this exercise on a daily basis. You’ve heard Warren Buffet suggest that you should be greedy when others are fearful, and fearful when others are greedy. Well, if you agree with that statement, then realize that it’s impossible to be greedy when others are fearful if you’re running with a pack of lemmings.

Rise above, think outside of the box, get a bigger box if you have to, because perspective is the key to making this work. Most importantly, you must realize that often perspective, comes with proximity. I’ll illustrate this by first asking you a question. What happened on October the 19th, in 1987?

Santa Claus & The Black Monday of 1987

Let me give you some back story first. I was in my first finance 101 class at the University of Alabama. I want you to get the image of Santa Claus in your mind. Older fella, white hair, white beard, rosacea in the cheeks. This guy bounced into class every day, always happy, and he would always begin the session with the joke of the day. Mind you, these were the corn ball kinds of jokes that made you bury your head into your hands. He made the class fun, and you never wanted to miss his lecture.

On this particular Monday, he dragged into class, stoically, and was white as a sheet of paper. No joke of the day. He placed his book on the lectern and began writing on the board. It was such a stark change of behavior that my class mates and I exchanged glances, and wondered if someone had died or something.

As it turns out, on that Monday, the Dow Jones Industrial Average lost 22.6% in one day. Allow me to cast some current day clarity on that number. As of mid-day trading on Wednesday, the first of November, if we were to match that feat, the Dow Jones Industrial Average would be down by 7,500 points. (1)

Now let that soak in for a second. Can you imagine looking at your phone app one afternoon and realizing that the Dow had closed 7,500 points down that day?

Thirty-six years later, and across other major periods of disruption like both Gulf wars, the Russian Ruble crisis, 9/11, Y2K, Ebola, Sars, Afghanistan and Covid, we’ve never seen anything close to this again. Now, for perspective’s sake, remember that by the end of the year in 1987, the Dow Jones Industrial Average finished higher for the year by 2.3%. (1)

Now, I was in school, so I was unaware of what was happening, but I can only imagine the panic and negative sentiment that must have been pervasive with investors at the time. And, this was before the age of smart phones and the internet. Can you imagine how much worse the level of panic would have been had information been immediately available as it is today?

So, let me demonstrate one way that I use this historical event to help clients remain with perspective. Grab your checkbook and hold it in front of you. This is what losing over 22% in one day looks like. Now, touch your face and cover your eyes with the checkbook. This is what losing over 22% in one day looked like on October 19th, 1987.

Your vision is completely occluded. If you tried to walk, you would probably run into something and hurt yourself. Now, take the checkbook and place it on a counter top and walk five steps away.

This is what losing over 22% looked like, on October 19th, 2017, thirty years later. The dimensions of the event did not change. We still lost over 22% in one day. Your proximity to the event did change however. Notice that your vision is completely un-occluded.

I mentioned other periods of time, like both Gulf wars, the Russian Ruble crisis, Y2K, 9/11, Sars, Ebola, The Great Recession, and now Covid and its aftermath. There have been many other times when our vision has been occluded, and each time, with time, distance, and proximity, vision and clarity have been restored.

When you’re working with a professional financial advisor, you are relying upon us to have the dispassionate outlook, and the thick skin necessary to avoid the persuasion of herd mentality, as we tactically manage portfolios through such periods of occlusion toward the end of accomplishing long term planning goals.

Seizing Opportunities Amid Financial Fear

Why is having intestinal fortitude and perspective important during times such as these? Within previous articles, I’ve described what I call, “coiled springs”. Think of a spring. As anxiety and sentiment become palpable, that spring is crimped down more and more tightly. At the peak of the anxiety, there’s a lot of potential energy stored in that coiled spring. This is an analogy for under-valued stocks. In my opinion, by the quantitative data, there are a myriad of stocks that are trading at levels that are lower than they should otherwise be trading.

By keeping a long-term perspective, you’re making such periods of anxiety work for you, by having the intestinal fortitude to be greedy when others are fearful, and accumulate new, or more shares of such companies at fear induced lower price points.

One day, a catalyst emerges that causes the market to recognize the coiled spring. This could be a positive comment from an analyst, or a better-than-expected earnings report. The paradox of a coiled spring is that you must be sitting on it before it pops if it’s going to be of any benefit to you. Much like being unable to surf a wave once it’s passed you by, likewise you can’t chase an uncoiled spring. You either had it or you didn’t.

So, the danger is giving into fear induced capitulation, and sitting in cash, and missing what could be a sharp and sudden rebound in the value of a company upon which you gave up and sold at the wrong time. Tactically manage your portfolio from quarter to quarter, yes, but remain vigilant toward the achievement of goals. Over the 36 years since the worst single day in the market’s history, we’ve established many subsequent new highs. This period of occlusion will pass eventually as well. The only question, is will you be ready and well positioned when it does?

Covid Orphans

Many clients have asked about how a company that should be trading at higher values, can find itself trading at significant a discount. How does that happen, and how do you recognize such value when it exists?

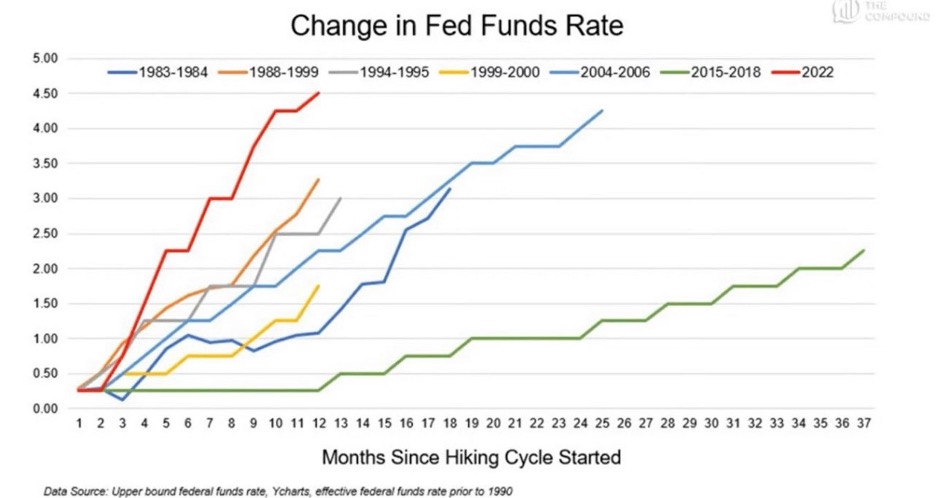

I’ve talked about this in previous articles as well. Quantitative data. Follow the data, not the sensationalism. This is especially true as it pertains to the Federal Reserve, and the shock that markets felt when the approach to removing accommodation was as heavy handed as we’ve seen in 40 years.

There are a basket of stocks for example that I refer to as being “Covid orphans”. These are stocks that surged to untenably high levels during the crisis. We were working from home, consuming from home, and the stock values of companies that made it possible for us to continue moving forward skyrocketed.

Post crisis, we observed profit taking, and in my opinion, short selling on the part of hedge funds, that drove the values of these companies into untenably low valuation ranges.

Then the Fed stepped in and it has preoccupied the market’s attention ever since. In my opinion, there are many companies that were overly sold, and just forgotten about when the Fed redirected the attention of the market.

Follow The Data, Not The Heard

I use quantifiable data, and dispassionate diagnostic tools, to evaluate these opportunities of value dislocation. I have no idea when these coiled springs might pop, but I am comfortable in my analysis of the valuation, and furthermore, I’m comfortable with the acquisition of more shares, the dilution of cost basis, and waiting on the market to wake up, once we have greater clarity and proximity to the event that caused the dislocation in the first place.

(1) https://www.investopedia.com/terms/b/blackmonday.asp

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 32 years, and is the President of Keystone Financial Group in Trussville. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results. Examples are for illustrative purposes only and should not be considered representative of any investment. Investments involve risks, including loss of principal.