Throughout 2023, we talked at length about navigating palpable sentiment, and the Federal Reserve, inflation, and the economic backlash of all things related to the COVID crisis. But today as we review the 2024 financial market outlook, I’d like to share some optimism about the coming year.

2024 Financial Market Outlook - Is This The End of the Beginning?

Within our previous article, I drew reference to the stock market crash of 1987, and how such periods of turmoil can occlude the vision of the markets. As time passes between now and the origin of the angst, you get proximity with time. With proximity, you get a return of vision. With vision, undervalued opportunities become increasingly clear, and before you know it, markets begin to re-price risk in a positive manner. I think we’re beginning to see this happening. I don’t believe that we’re necessarily out of the woods, but to quote Winston Churchill, this isn’t the beginning of the end, but it may indeed be the end of the beginning.

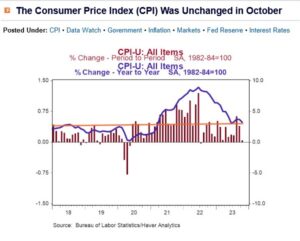

As it pertains to inflation for example, I’ve written about how inflation has been a major source of concern over the last three years. Recently, there was a survey suggesting that 58% of respondents felt that inflation was an emergency.

Not a problem, not an issue, not a nuisance, but an emergency. By the data however, would you believe me if I told you that the rate of inflation is back to where it was prior to the pandemic?

The Current Reality of Inflation

It is. Most people don’t feel it however. This isn’t a data issue. It’s a duration issue. Our capacity to consume has only been imperially positive over the last three months. Well, three points of data will not outweigh thirty-six points of data.

It is. Most people don’t feel it however. This isn’t a data issue. It’s a duration issue. Our capacity to consume has only been imperially positive over the last three months. Well, three points of data will not outweigh thirty-six points of data.

I need to see 15 more of these data points where inflation is lower than the degree by which our incomes are rising before I can have confidence that attitudes toward consumption might change. Indeed, Dr. David Kelley recently observed that we have a bottom decile attitude toward a top quartile economy.

The good news about sentiment is that it eventually fades, and as it does, the investment landscape changes in perspective as well. I believe that if this recent pattern of inflation remains in place, that increasingly positive attitudes toward consumption could lead to greater patterns of consumption, which then potentially sparks a shift away from being efficient, to expanding the capacity of plants to manufacture more of that which is being demanded in greater quantities. I believe that could potentially unfold in 2024, and be a positive thing for market participants.

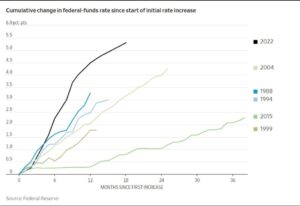

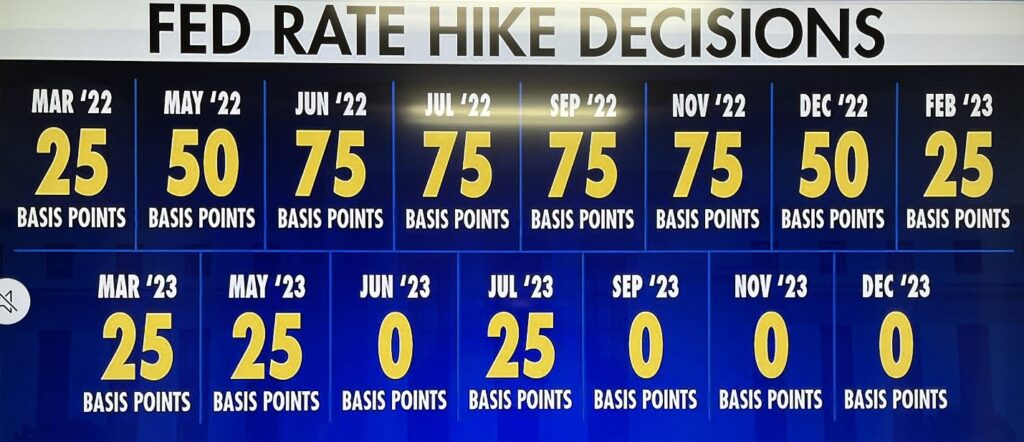

Over the last two years, I’ve written much about the Federal Reserve, and described how market participants have seemingly feared that the Fed might revert to a more hawkish posture in the future.

Again, in my opinion, market response is a function of the magnitude of the shock. I believe that the Fed shocked markets with its approach to removing accommodation. Was the Fed just that opaque and ambiguous, or did the markets mis interpret the message? It’s been my contention all along that the Fed was clear that the goal was to remove accommodation. Initially, they offered little in terms of scope and timeline, but we knew that a massive amount of accommodation would be taken back. I believe markets conflated this with solely the fighting of inflation, and I believe that was the wrong conclusion to draw.

A Discernable Shift

I believe market participants were expecting a longer and more tepid approach to the removal of accommodation, similar to what we experienced in the 2015 tightening cycle. What we got was Paul Volker 2.0 and the most aggressive Fed in forty years. This was a shock to the markets. The greater the magnitude of the shock, the longer it takes from which to recover.

I believe market participants were expecting a longer and more tepid approach to the removal of accommodation, similar to what we experienced in the 2015 tightening cycle. What we got was Paul Volker 2.0 and the most aggressive Fed in forty years. This was a shock to the markets. The greater the magnitude of the shock, the longer it takes from which to recover.

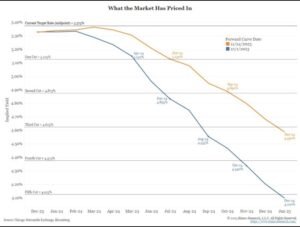

So, the question becomes, has the Fed done exactly what they said they were going to do? Yes, I believe so. In November of last year, Chairman Powell told us that the Fed would be less hawkish, more data driven, and judicious with future policy decisions.

Well, it looks like they’ve done just that. By the numbers, it’s even more evident, but I don’t think that fixed income or equity market participants actually believed it, until possibly, just now.

Looking at this chart, it would appear that by the actions of treasury market participants, there is now a discernable shift, just since Thanksgiving, about where market participants believe future Fed policy decisions may land next year.

The Fed has been conveying the same message now for thirteen months. Seemingly, only now has the treasury market heard it. I think this is a positive development as we launch into the new year.

The Fed has been conveying the same message now for thirteen months. Seemingly, only now has the treasury market heard it. I think this is a positive development as we launch into the new year.

Throughout the year, I’ve spoken about how in my opinion, the market is broadly undervalued, and seemingly being led by a narrow basket of AI thematic companies. Indeed, that remains true. I can’t get into a discussion of specific stocks of companies in an article such as this, however I do believe that the overwhelming majority of the market remains very attractively priced when viewed from a forward PE perspective, and other metrics.

Recently, I found this stochastic view of the market.

At a high level, stochastic analysis is simply observing points of strength and resistance, and then connecting those dots to form Bollinger bands. When you hear that markets are bouncing off of strength or running into resistance, it is to these Bollinger bands to which reference is being made.

Looking at this graphic, it would appear that a cone convergence is underway. That’s exciting in and of itself, but it’s even more exciting to see that the fifty-day moving average, and the two hundred day moving average and the current valuation of the market are seemingly converging at the same time. Something is about to happen.

Any good stochastician would tell you that if you breech a Bollinger band and close above or below that level, there is a good probability that you’ll establish that resistance or support level at 10% to 15% higher or lower than the previous level.

Well, notice the blue line, and where the S&P Index was just three weeks ago, as it was flirting with that upper-level resistance. Since then, we’ve heard from Chairman Powell following the December Fed meeting, and the market closed well above that upper level of resistance.

That’s a good technical indicator if you’re into such things, that we might be positioning ourselves for a reasonably green 2024.

Election Cycle Impact On Market Performance

Many have asked if the election cycle might that have an impact on market performance the 2024 financial market outlook. In my opinion, the House races might have an impact on market sentiment. Spending starts and stops in the House. The most recent auction of new ten-year treasury debt did not go very smoothly, and there remain concerns over whether the Fed can land this removal of accommodation softly.

The Fed is unwinding its balance sheet and the world is flooded with an over-abundance of US treasury debt supply. We’ve talked about this in previous articles. Well, the more spending we have in Congress, the more new pieces of debt that we auction, and if the last auction is any indication, those yields will be increasingly higher due to the over-abundance of supply that we have on the open global market. That’s a headwind to the Fed’s attempts to land the removal of accommodation softly.

If the disposition of Congress is more conservative however, then by extension, we can assume that spending might curtail, and result in a lesser quantity of new debt than we might have had otherwise, and such in my opinion would be viewed favorably by the markets, and as a tail wind to the Fed’s efforts. Also, remember that by the statistics, markets generally perform well in election years.

2024 Financial Market Outlook - In Conclusion

So, to summarize my 2024 financial market outlook, why am I waxing optimistically about the coming year? Inflation has been falling by a faster rate than the degree by which wages have been rising by a declining rate. Purchasing power has been less negative now, month by month for over a year. Now its empirically positive. Consumer confidence is rising as a result.

The Fed, in my opinion, has signaled that it is likely at the end of its endeavor to disincentivize lending and borrowing. The inflationary rate of change is back to where it was before all of this mess began. Bond yields have, in my opinion, spiked and are now floating down, and present less of an allure away from equity markets.

Stochastic data is pointing in a positive direction. The economy seems to be in OK shape, with tepid growth forecast for the coming year, but this in my opinion is a much better outcome than for which the market may have anticipated three years ago.

Are there still some concerning areas? Sure, which is why I said earlier that this might only be the end of the beginning, but I do believe that much of what the market had feared, and priced into valuations, has either not come to fruition, or has come to fruition in a much more docile manner than anticipated.

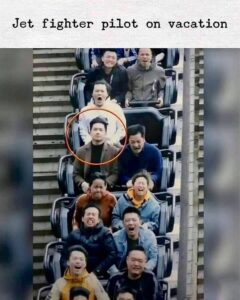

There are no ringing bells or alarms to signal when palpable sentiment begins to dissipate. Which is why you must find the intestinal fortitude to be this guy, the jet fighter pilot on vacation when it comes to resisting the urge to succumb to sensationalism and speculation. Rise above, think outside of the box, and remain focused on the long term and the fruition of planning goals.

There are no ringing bells or alarms to signal when palpable sentiment begins to dissipate. Which is why you must find the intestinal fortitude to be this guy, the jet fighter pilot on vacation when it comes to resisting the urge to succumb to sensationalism and speculation. Rise above, think outside of the box, and remain focused on the long term and the fruition of planning goals.

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 32 years, and is the President of Keystone Financial Group in Trussville. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results. Examples are for illustrative purposes only and should not be considered representative of any investment. Investments involve risks, including loss of principal. Contact Keystone Financial Group today to receive Advisement.