Within my last article, I outlined the reasons for my optimism as we began the new year. Today, I’m going to continue that discussion as it pertains to changing economic cycles and seasons.

Economic Cycles

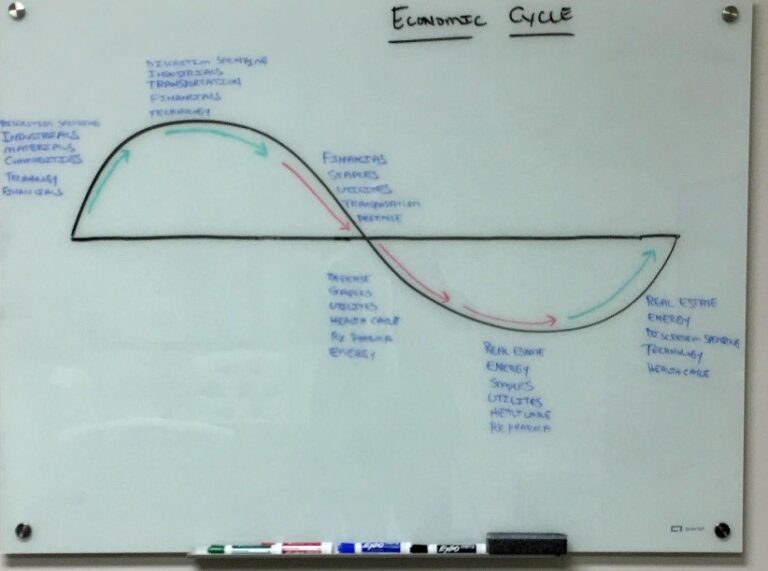

On several occasions over the previous years, I have drawn reference to an image of explaining the economic cycle. I saw this for the first time when I was in school 37 years ago, and throughout the duration of my career, I cannot remember a time when this hasn’t been a valuable tool for portfolio construction.

I have encouraged clients to think of this economic cycles in terms of seasons. Starting at the left of the chart, we emerge into economic spring, and then into economic summer, fall, winter, and ultimately back into economic spring at the far right of the graphic.

I suggest that clients consider how their behavior is incentivized by how they feel. When it’s cold outside, as it is now, you’re more likely to wear jeans and jackets, and find yourself spending more time indoors, and probably in front of a fire. During periods of economic summer, when it’s 98° outside, you’re probably not wearing jeans and jackets.

At such times, you’re incentivized to wear short sleeve shirts, shorts, and rather than being in front of the fire, you are most likely at the beach or on the lake.

Likewise, economic cycles, or seasons, will incentivize your consumption behavior as well. During periods of economic winter, you are more likely to focus on things that you need, including food, pharmaceuticals, healthcare, utilities, and other durable staple kinds of items.

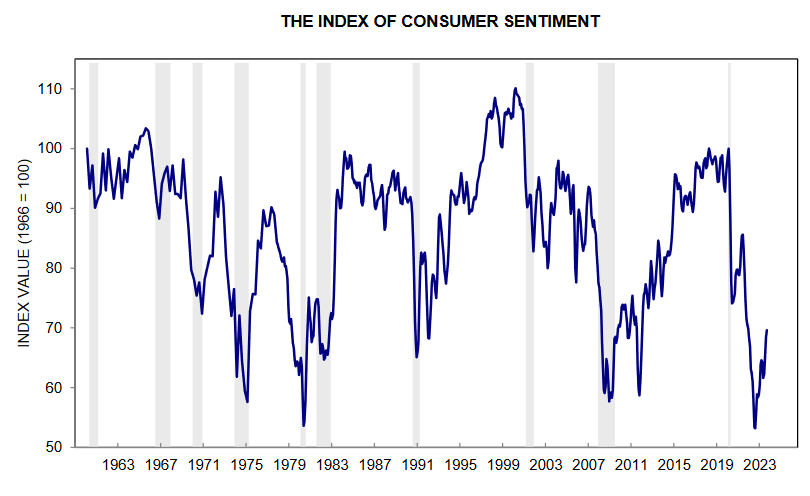

However, during economic summer, when discretionary income is plentiful, you will likely consume greater amounts of products and services that you don’t necessarily need. We can get a sense of where we are in the economic cycle by observing levels of consumer confidence, and other metrics that we can use to gauge the attitudes of consumers. This is important because consumption is 70% of GDP. If you feel poor, then patterns of consumption will likely reflect that sentiment.

Returning to the analogy, that economic groundhog has seen his shadow for the last four years. This has been an extended “El Nino” period of economic winter, and we have adjusted our portfolios tactically. But now I sense that attitudes are changing, and the temperature is feeling warmer, so I do believe we are emerging into economic spring at this point.

A Break in the Clouds

A few months ago, I offered my thoughts about pervasively palpable negative sentiment, and how that can influence asset prices. In my opinion, is this beginning to wane. To demonstrate this point, let me offer some insight into myself that may also resonate with many of you

Although I have never been diagnosed with light deprivation syndrome, I can tell you that in the winter months, when there is increasingly less daylight, I can become somewhat cranky. It becomes even worse when that is accompanied by weeks of overcast, gloomy and gray skies.

At some point however we get a break in the clouds. Imagine how much better you feel when you look up and finally see the sun peeking through the clouds, with that beautiful blue sky in the background. It may still be 30° outside, but the return of sunshine can quickly change the way you feel after several days of gloomy overcast skies. Right now, it is my belief that 2024 could bring a welcome relief from four years of overcast skies, and a positive repricing of risk. In my opinion, the market has worried about many things that have just not come to fruition, or may have come to fruition in a much more docile manner than previously feared.

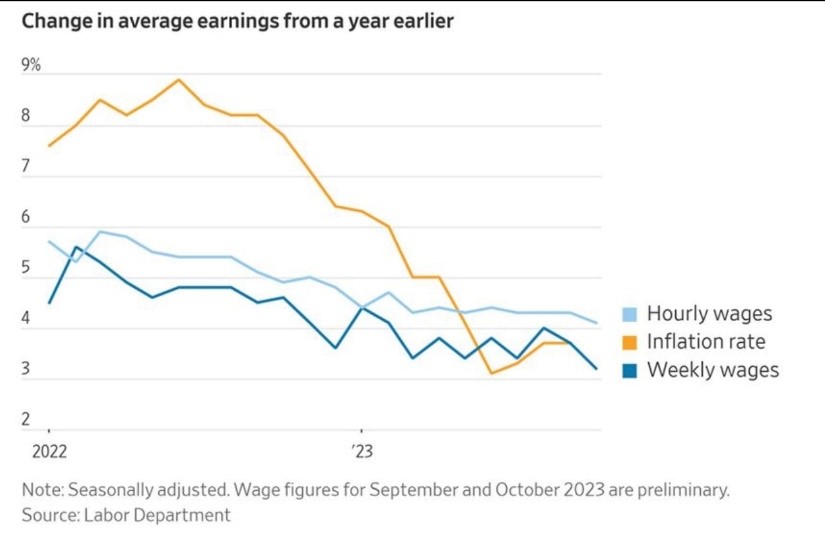

For example, the average consumer may not fully appreciate this yet, but the data over the last 15 months indicates that inflation has been declining at a faster rate than the degree by which our incomes were rising at a declining rate. In other words, our capacity to consume has been consistently less negative, every month, for almost the last year and a half.

From the perspective of financial physics, if inflationary pressures have been abating consistently over time, then at some point I would expect to see a corresponding improvement in the sentiment of the average consumer. Again, back to the sunlight after a long period of overcast skies analogy. This is important because if you’re feeling better about your economic disposition, then at some point that will translate into improving patterns of consumption, and thus better than expected earnings and revenues from the companies that manufacture the items being purchased in greater quantities. So, tracking consumer sentiment is tactically important.

Indeed, since November 2022, according to the University of Michigan and their consumer confidence survey, we have observed confidence rising gradually. Now for reference, the reading observed in November 2022 was a historic low point for this index. Since the inception of this metric, the average consumer had never felt more-dour about their ability to consume.

So, while we have improved tremendously since then, we still have a long way to go. But from a tactical management perspective, it is the observation of data such as this that leads us to believe that now would be an opportune time to begin gradually shifting the focus of our portfolios away from being heavily defensive, to incorporating a greater degree of growth assets that typically prosper during periods of economic summer.

From a tactical perspective, when it comes to managing portfolios, the duration and frequency of the distress event can be an impediment when it comes to encouraging clients to be patient, and make such periods of distress work for their benefit. So, how do we accomplish this?

Well, as Rudyard Kipling wrote in his poem, If, my clients are depending on me to keep my head about me when all those around me are losing theirs. Said another way, my clients are depending on me to be this guy.

As a product agnostic, fiduciary manager of wealth, I serve my clients in a number of ways. In this case, I must be that stoic jet fighter pilot on vacation as we ride yet another scary roller coaster. Across the 33 years of my career, I have ridden many of these things, and I know we are the gift shop is located. I know how this ride ends.

Rather than be persuaded by pervasively negative and palpable sentiment, I must be stoically disciplined as I help clients wade through the fog of that sentiment, to determine whether there is anything rational supporting it. If not, then such periods of time create opportunities. As Warren Buffett said, be greedy when others are fearful.

Well, it’s impossible to be greedy when others are fearful, if you are running with a herd of lemmings.

Significant periods of disruption, that are long in both frequency and duration, can foster panic driven, herd of lemming’s mentality. I have to be able to discern fact from fiction, and help clients manage volatility to the degree possible, and to take advantage of opportunities when available, through dispassionate, and tactical management of their accounts.

We accomplish this with proactive, and frequent communication, and with an intentional deep dive, on a quarterly basis, into the mechanics of their portfolio, as we gauge performance against the assumptions made within the governing plan. By doing this, we return the focus to the objectives that we are trying to accomplish as a function of planning goals.

If you agree with me that evidence suggests a changing of economic seasons, then the next question is usually about asset prices that may be undervalued, and when do we think we can expect market valuations to return to normal as we emerge from one season to the next.

Clearly, that is indeed the million-dollar question. And yes, I have an analogy with which to demonstrate my thoughts.

Shocks to the Economic System

I have encouraged clients to think of a given stock as being a ball floating on the water. The water is the economic environment that supports the company within its sector. If left to its own devices, the ball will rise as the water rises, and the economic environment becomes more favorable for that company, and its sector. Conversely, the ball will fall if the water level decreases.

Then along comes the metaphorical hand that artificially holds the ball under the water. This hand can take the shape of irrational fears, shocks to the economic system, a Federal Reserve that is more aggressive than anticipated, fears over another round of potential bank failures, geopolitical events, and other things.

The ball is under the water. It shouldn’t be, but it is.

This is when I channel my inner jet fighter pilot on vacation to determine whether or not that hand is rational. Can I translate that to a quantifiable figure on a spreadsheet? If not, then the question becomes, when does that hand release the ball? When does sentiment dissipate?

I can’t answer that question, but I believe that point of inflection remains in our future. What I do know is that when the hand releases the ball, it will not remain underwater. It’s financial physics. It will return to the surface where the economic environment supports its valuation. In the past, I have referred to this phenomenon as the uncoiling of a tightly wound spring. We are beginning to see this at the present time.

Summary

So, in summary, I do believe that we can quantify economic cycles as the changing of seasons. We can observe attitudes toward consumption that are improving, that seems to be translating into increasingly better patterns of consumption. The Federal Reserve has taken no action in five of the last six meetings. Bond yields may have peaked as a result.

A Stochastic analysis of market behavioral data suggests that Bollinger Bands are being re-drawn. The yield curve inversion that was once 108 basis points, stood at only 20 basis points by the end of last year.

In my opinion, if these trends continue throughout the current year, then it is possible that we could see many of these submerged balls returned to the surface. My job, and that of any holistic manager of wealth, is to do what can be done to tactically, proactively, and dispassionately allocate client accounts so that they might benefit from this potential change in economic seasons.

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 32 years, and is the President of Keystone Financial Group in Trussville. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results. Examples are for illustrative purposes only and should not be considered representative of any investment. Investments involve risks, including loss of principal.