This Article Briefly Looks at Stock Market Volatility and its Longevity.

In last month’s article about inflation, we learned how it was having a huge impact on patterns of consumption behavior. This month, we will explore what to expect in this period of volatility.

Click the video for additional footage on:

Is This Stock Market Volatility Rational, and Will It Ever End?

Click the video to see how it applies to you.

Inflation Is Cutting Into Wages and Impacting Spending

In a recent article from Insider.com, a Bloomberg economist suggested that the average consumer would have to budget $5,200 more this year to pay for the same basket of goods and services as last year. This may be possible if you earn half a million dollars per year, but what about the millions of families who earn $50,000 per year? It would be impossible for those families to make an extra 10% materialize out of thin air.

With that in mind, get ready to hear the word “austerity” a lot for the rest of this year.

Austerity is essentially the exercise of deciding what will be cut from your budget until either your wages rise or the prices of things you buy fall.

If patterns of consumption are changing, then so should the revenue and earnings assumptions for the companies that make and sell products and services. Is Company X really worth $200 per share, or in light of weakening sales activity is it now only worth $150 per share? That’s a high-level example of what is happening in the market. The economics of wages not rising as fast as inflation, and the impact it is having on patterns of consumption, causes the market to reprice risk, and sometimes, quickly.

When Will Volatility End? When Risk Is ‘Priced Out’

I believe the current market volatility will not end until enough risk has been priced out of the market to balance valuation against perceived risk.

Right now, that is largely a function of the Federal Reserve. In my opinion, I believe they waited much too long to enter into quantitative tightening. They told us for too long that inflation was transient, but instead, it has proven to be stubbornly persistent and pervasive.

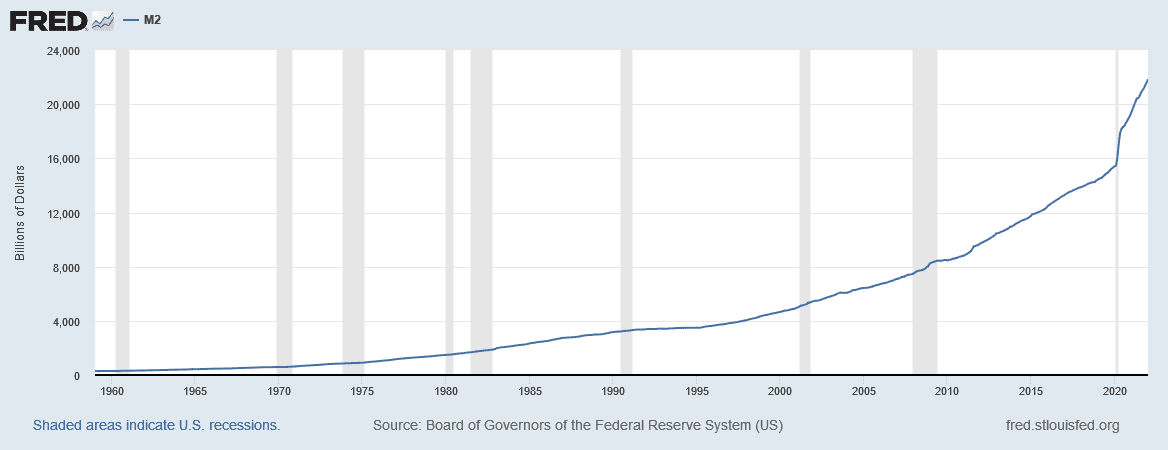

Because of this, the Federal Reserve is having to play catch up in an effort to quell the inflation being caused in large part by the precedent-setting amount of money they printed over the last two years.

Rather than a gradual and modest approach to tightening, the Federal Reserve continued to print money and add to its balance sheet through February of this year.

This is akin to sprinkling gasoline on a fire and believing it will help to extinguish the blaze because it is wet. The Federal Reserve is having to be much more active, in terms of policy and unwinding its balance sheet, and the market is pricing into itself the odds that such might hasten, or worsen a recession.

Is This What a Recession Looks Like? Yes

I suggested in 2021 that we could find ourselves in a recession by 2022. Most media outlets suggest that the risk of a recession will be even greater next year.

But frankly, I think we are in the beginning stages of a recession now. We have already seen the first negative read on Q1 GDP, and I do not see anything on the horizon that could change that outcome.

Furthermore, I do not anticipate anything changing in time for Q2 to reflect a positive GDP outcome, either.

If the definition of a recession is two consecutive negative quarters of GDP output, then we may already be in the recession. The question of for how long, and how deep, is anyone’s guess.

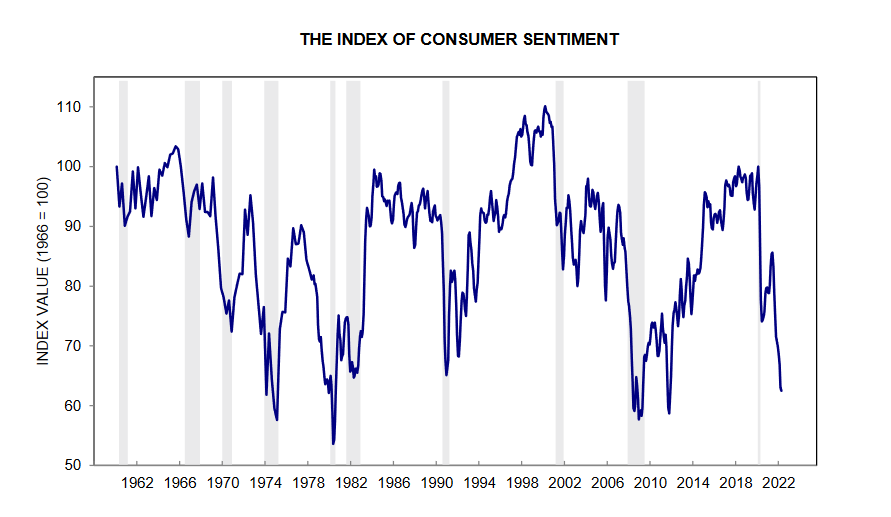

Confident consumers spend money. According to the most recent University of Michigan consumer sentiment survey, we have the third-lowest confidence reading since the Great Recession.

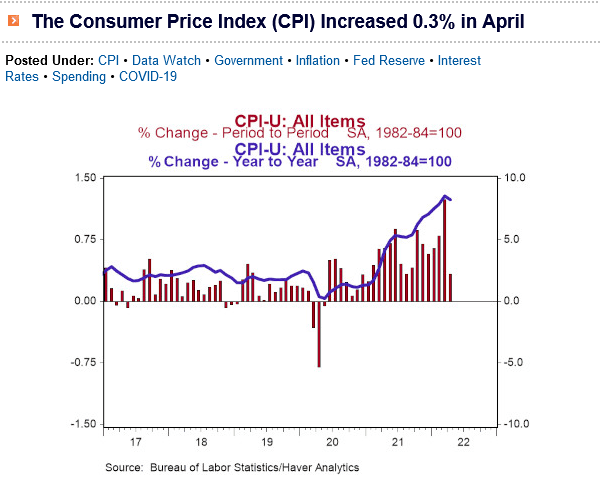

Headline inflation remains stubbornly high at 8.3% year over year as of April, and those forces do not seem to be abating.

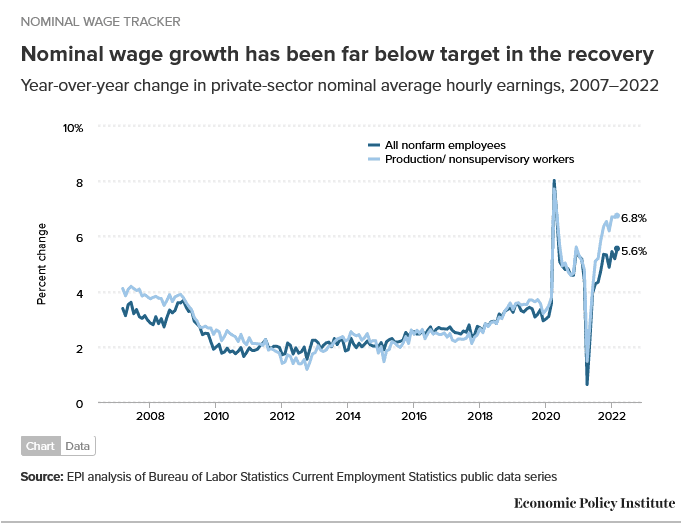

Over the same period, as shown in the graph above, non-farm payrolls grew by 5.6% net after tax. If the average consumer kept 4.7% of that increase yet inflation rose by 8.3%, then for a fifth consecutive rolling 12-month period our capacity to consume has declined.

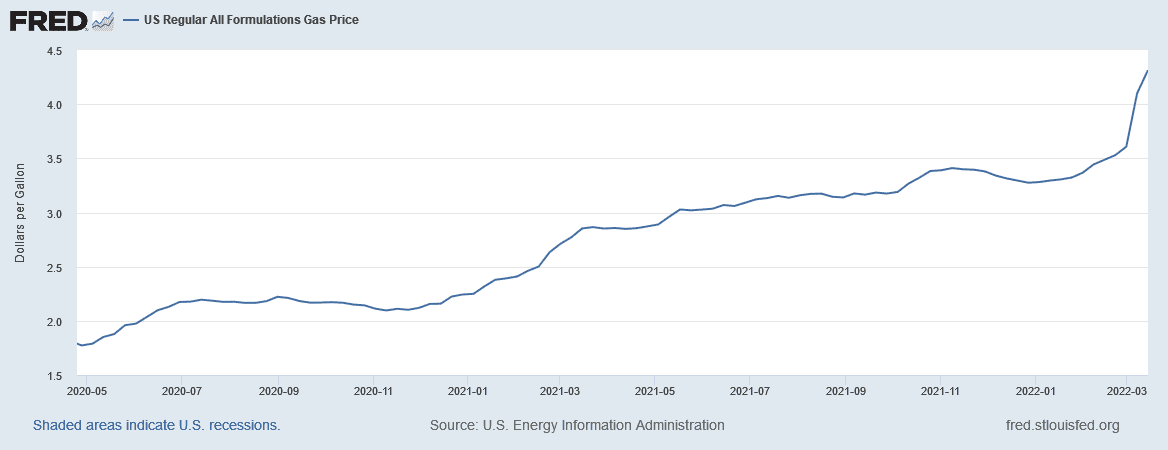

Note, of course, that not everything we consume went up by 8.3%. Some economically inelastic things, like gasoline, have risen at a much faster pace.

This is due in large part to supply chain disruptions caused by the war in Ukraine and other logistics problems. The higher cost of fertilizer has hit grain growers around the world, and now we anticipate significantly higher food costs for the rest of the year.

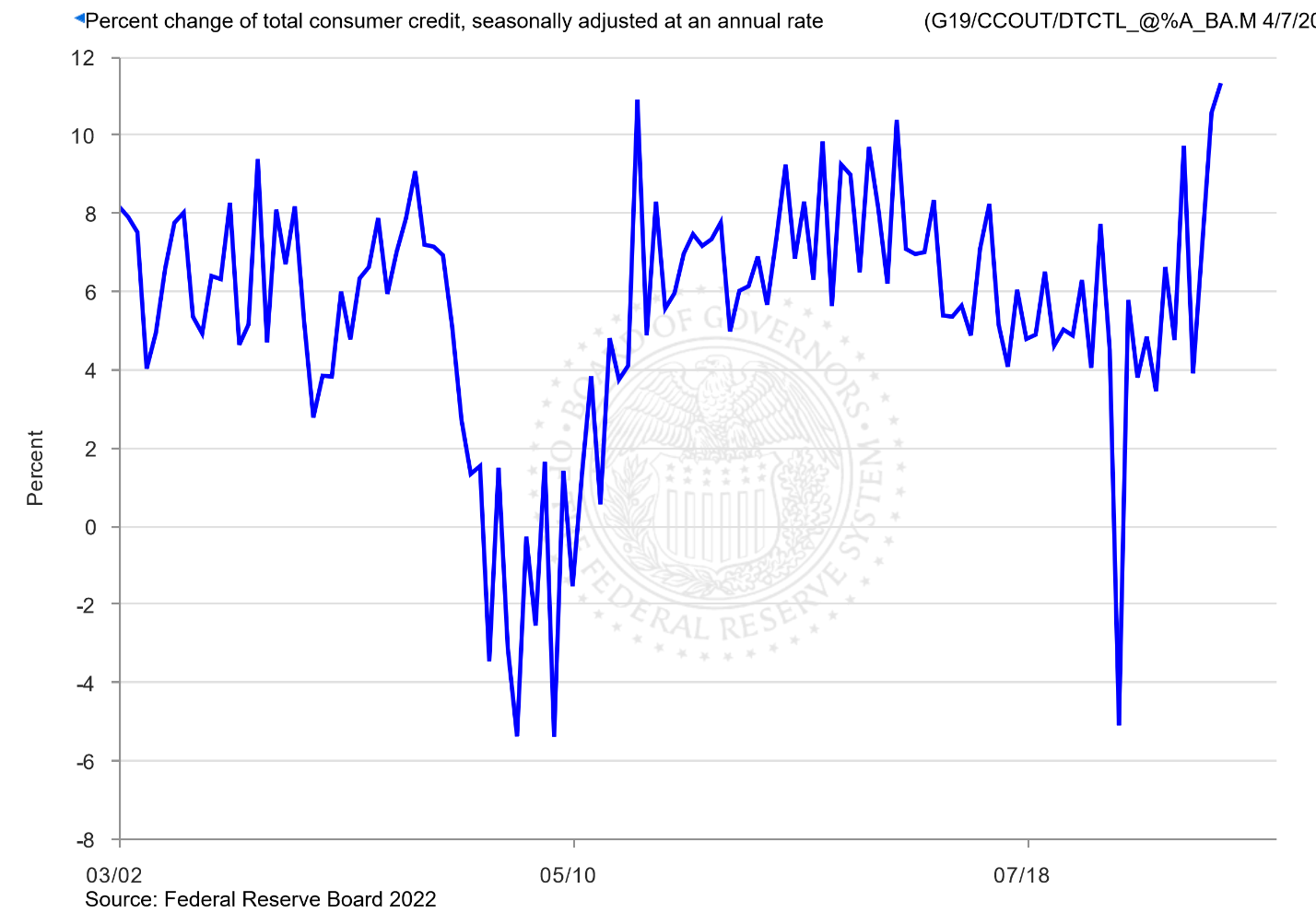

Meanwhile, according to the Federal Reserve, the average household use of consumer credit is higher today than at any point over the last 20 years, including the Great Recession.

With these facts and others in mind, I am not optimistic about the potential for economic growth.

I believe that we are in a recession already. The recession is being exacerbated by the actions of the Federal Reserve, which is doing things that are normally done when the economy is expanding too rapidly and they want to disincentivize borrowing.

Right now, companies are focused on being lean and efficient, not larger. The economy is contracting, not expanding.

How Should You Invest Right Now? Stay the Course

The big worry among many investment professionals is that the Federal Reserve’s efforts to reign in what they spent two years creating could be coming at a very bad time — when the economy is already contracting. A mild recession could become a bad one. That is why this period of market volatility makes sense to me and why we should adjust our economic outlook accordingly.

For the average person putting money into their 401(k), the key to navigating this recession and stock market volatility is to stay the course. The worst thing you can do is quit.

- People must be mindful of goals that are 10 years or more into the future.

- How you handle your 401(k), IRA or investment account should be guided by an overarching financial plan. Investing without a plan exposes you to unnecessary risk. Focusing on minute-by-minute market volatility will keep you up at night.

- As mentioned in last month’s article, successful, long-term investment management is planning first, execution second. Execution is important, but not more important than the plan that governs the account.

- Pay attention to what investments you own. Do not take an autopilot approach to your investments. There are times to own the stocks of growth and discretionary spending companies, and there are times when it is best to own the stocks of companies that make economically durable products that you are going to consume regardless of the state of the economy.

A good investment strategy is to look for companies trading with attractive price-to-earnings ratios, that are priced fairly, and that pay attractive dividends. That is the defensive way to survive in this environment of volatility.

Pay attention to the fixed income portion of the portfolio, because with the Federal Reserve in quantitative tightening mode and with two inverted yield curves, you might want to curtail long-term exposure to debt instruments that are suffering from significant price distortion.

Remember, this is a marathon, not a sprint.

*David R. Guttery, RFC, RFS, CAM, is a financial advisor and has been in practice for 31 years. He is the president of Keystone Financial Group in Trussville, Ala. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided here is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.