Don’t Ride the Rollercoaster

Throughout the year, we’ve talked about the possibility of being in a recession and potential strategies for consistent investment during this time. In this article, we will discuss why it is critically important to avoid the emotional roller coaster if financial planning efforts are to succeed.

As I have mentioned on several occasions, if I could offer one universal piece of advice to anyone reading this article and pursuing long-term financial planning objectives, it would simply be to not quit during such times. Investing in a recession is crucial for long-term success.

At times, there seems to be a mindset that discontinuing investments into qualified plans or simply letting those deferrals accumulate in cash makes for the better option when we have economic uncertainty and market volatility.

However, I strongly disagree with this view. What you do today could have a measurable impact on where you arrive tomorrow. That doesn’t mean your portfolio won’t change. As market factors and economic conditions change, your portfolio will adapt.

Click the video for additional footage on:

Strategies for Investing During a Recession.

See how this video applies to you.

How To Invest in a Recession – Long-Term Investment Plans

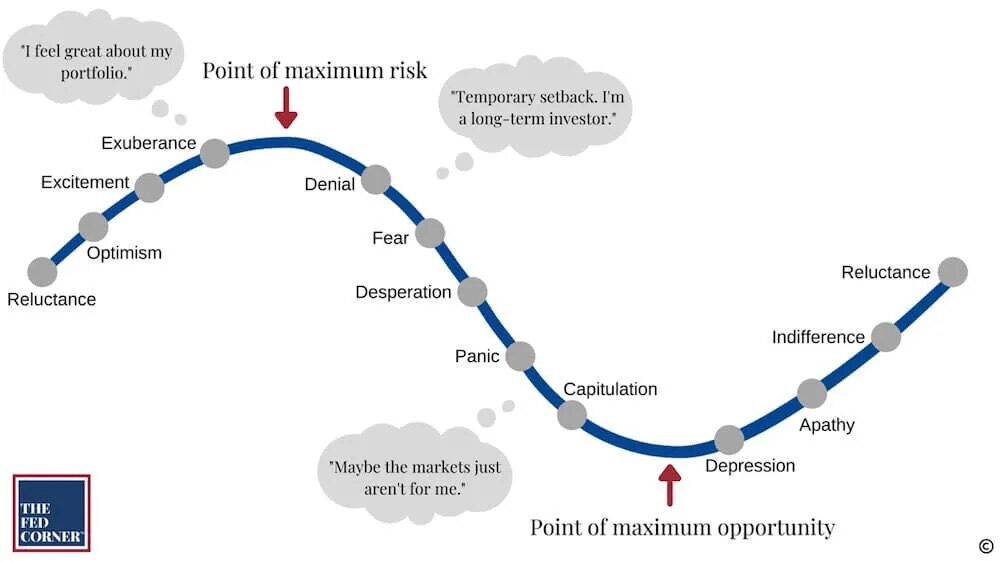

To illustrate this point, I will walk through this graphic in three parts, discussing my thoughts about the emotional roller coaster we must avoid as we try to bring long-term financial planning objectives to fruition.

You may recognize this graphic as very similar to a depiction of the economic cycle I have described previously.

One of the key roles I have as a financial advisor is to remain dispassionately focused on the long-term objectives we have codified within our financial plans. And in the process, helping clients avoid this emotional roller coaster.

The Most Opportunist Time to Invest

Let’s start on the far left.

To set the stage, the economy is growing, markets are faring well, and each month when you receive statements, you are excited by the growth of your investments. Often, this causes you to metaphorically throw caution to the wind. You begin to assume risks outside the boundaries we codified within our financial plan. After all, the risk is always easy to assume when everything is going up, correct?

Ironically, while you feel exuberant about your portfolio, we are nearing the point of maximum risk. In this part of the cycle, one of my main tasks is keeping clients oriented on the path we have implemented to achieve long-term goals. Unfortunately, during these times, we can inadvertently undermine that effort if we are not mindful of risk guardrails.

Now consider what I call the mid-cycle phase – I believe we are experiencing this part of the current cycle.

To set the stage – we have begun recognizing red flags concerning the economy. Markets have started repricing risk in recognition of those red flags, and we are beginning to see negative results to a small degree. However, we are still exuberantly confident in the portfolio’s past performance.

First, we contend with the denial that market and economic environments are changing materially. Ultimately, that gives way to fear and the thought, “ I hope I was right in that assessment.” Then, after more losses accumulate, we begin to look desperately for immediate solutions to stop the bleeding, leading to trading that realizes losses that previously existed on paper.

As the devaluation continues, we hit panic mode – also known as capitulation. This is when an investor is emotionally exhausted and liquidates everything to cash because they may have remained with an investment strategy from which they should have exited long ago.

Ironically, this is often the position in the cycle when we are close to the point of maximum opportunity or the bottom of the market.

I have said this on many occasions, and I will reiterate it here – no one, regardless of how well-qualified, can accurately predict when the bottom of the market may occur.

For this reason, you must constantly assess areas of market exposure and limits of risk relative to the goals being pursued.

The Riskiest Time to Invest

Now, consider the far right of the graphic – I call this the late-cycle phase. Here, I believe the most significant amount of risk is present as it pertains to achieving long-term goals. For example, many clinical studies have shown that psychologically, people are five times more likely to avoid pain than to gravitate toward pleasure.

This is why I believe the greatest amount of opportunity cost risk is present in this phase. The pleasure of positive returns is not strong enough to outweigh the pain of recognized losses, so at the worst possible time, investors in cash following capitulation fail to do what they should do at the correct time.

So again, to set the stage, we have watched our investments outperform our expectations. Then, following denial, fear, and ultimately capitulation, we have locked-in losses just before the point of maximum opportunity.

Now we begin to see markets move on fundamental points of data. They began to rise gradually, and such things as earnings, revenue, and macroeconomic metrics once again seem to be driving market movements. You watch this from the sidelines, still sitting in cash, brooding over the large loss you realized during the capitulation phase. As the market continues to climb, this gives way to apathy.

The market continues to climb, and then we have a state of indifference. This is where investors think to themselves, well, if I get back in the market now, it will just retest the previous lows, and I’ll be right back to where I was anyway. So as the market continues to climb, investors reluctantly decide: the market is leaving me behind – I will put 25% of the cash back into the market.

As the market recovers, optimism begins to take hold, and another 25% is allocated back into the market. Ultimately, investors begin to feel comfortable that the worst is behind us and plow the rest of the cash into previously invested positions. The problem is – we are nearing the point of maximum risk again, where the cycle repeats itself.

The Importance of Consistent Investing Over Time

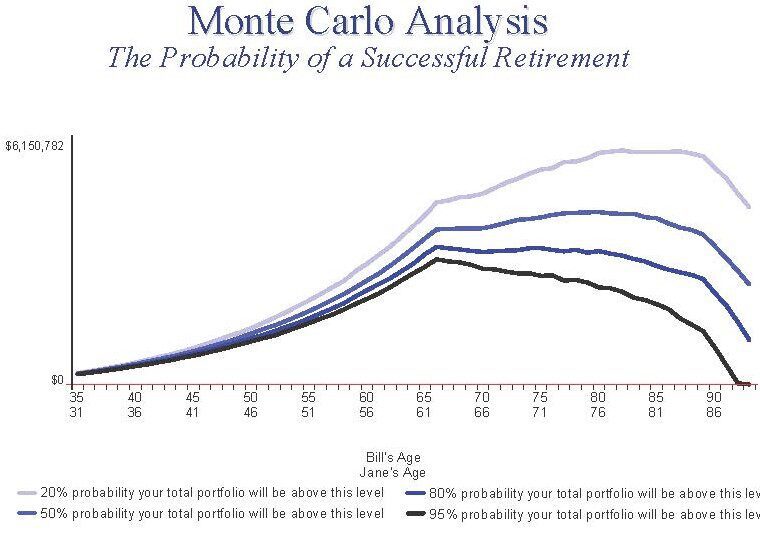

In closing, let me illustrate why it is essential to maintain consistency through such periods to achieve long-term goals. I took an actual client’s plan and turned it into a sample case for this example. I’m only going to demonstrate one slide from the client’s plan, and this is the Monte Carlo stress test of our assumptions. These clients are very young, in their early 30s, and we recently evaluated their retirement plan and implemented a strategy to achieve those goals.

This graphic depicts four confidence intervals, revealing that this strategy has a very strong chance of producing the results we are planning for. I made one change to the assumption reflected in this plan. I assumed that rather than a consistent investment strategy, this couple would discontinue making contributions to their qualified plans, for the next two years, in response to current market and economic volatility.

Look at the impact missing only two years of investment activity early in life has on the chances of success for the achievement of the long-term goal. With the first version, three of the four confidence intervals were significantly above, what I call, the red line. In the second version, three of the four confidence intervals not only touch the red line but are early enough that moving in with future children could be a possibility.

So, in conclusion, regardless of the period of time, or the state of the economy, the achievement of long-term goals is predicated on the consistency with which you meet the implementation of the strategy. Of course, the composition of the investment accounts will change to reflect current periods, but the approach, dedication, and commitment to the strategy should be unwavering. Even missing a few years, with the thought of letting a volatile market pass you by, can have a detrimental impact, 40 years down the road, on the potential success of a long-term financial plan.

*David R. Guttery, RFC, RFS, CAM, is a financial advisor and has been in practice for 31 years. He is the president of Keystone Financial Group in Trussville, Ala. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided here is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.