Costs Are Growing and Confidence is Falling, But Investors Should Remember This is a Marathon, Not a Sprint

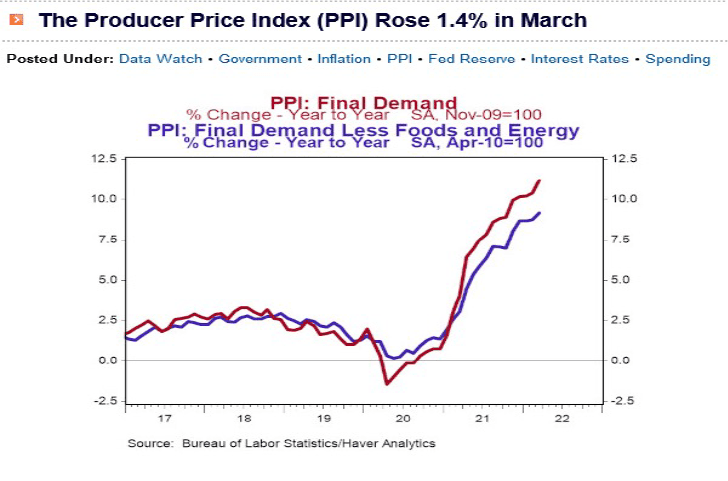

We’ve been suggesting for months that, in our view, inflation will not be transient and instead is likely to persist for the foreseeable future. Given data developments over the last year, it would seem our view has been proven right. Inflation remains stubbornly high, and finding any indication of a falling inflation rate is a difficult proposition indeed at this time.

Over the same period, we have observed inflation rising by 8.5% over the last 12 months for consumer inflation. This, as it was for business inflation, was the highest rate of consumer inflation that we have experienced since 1981

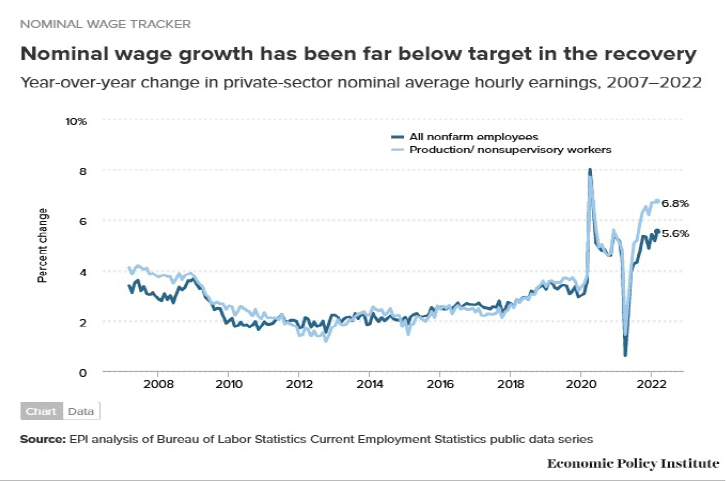

At a high level, I suppose that would be fine if the average income rose by 10% over the same period — so that, after taxes, your ability to consume was also increasing by the rate that it was declining. However, according to the Bureau of Labor and Statistics, this did not happen.

Household Income is Not Keeping Up With Inflation

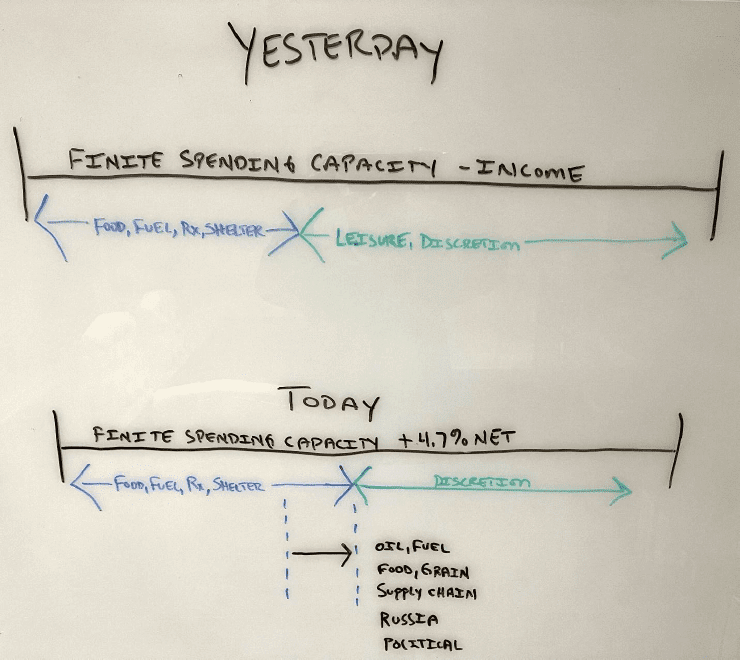

From the Bureau’s analysis, all nonfarm payrolls increased by 5.6% over the last 12 months. Net after-tax, let’s assume that you got to keep 4.7% of this increase. Clearly, by looking at each of these graphics, our capacity to consume is going backward. This is important because our gross domestic product is 70% consumption. If our ability to consume is going backward, then that increases the likelihood of seeing a recession, which is simply two negative quarters of gross domestic product.

Think about your income being a finite capacity to consume over any rolling 12-month period of time. You only have so much money to spend.

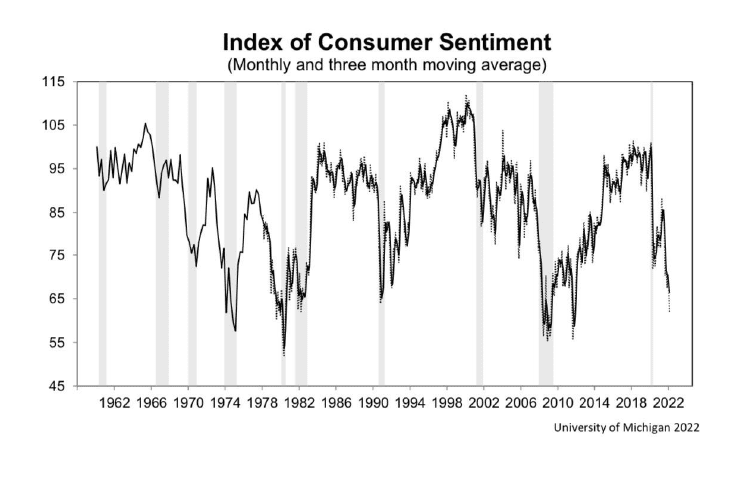

Previously, money that you allocated for economically inelastic things, such as food, fuel, healthcare, and shelter, claimed a much smaller percentage of your finite capacity to spend than it does today. The more that you must spend on these things, the less that you have to spend in other places. Typically, as that happens, consumer confidence declines. As that happens, patterns of consumer behavior change. People become much more focused on buying the next gallon of gasoline and the next roll of toilet paper than the next cup of designer coffee.

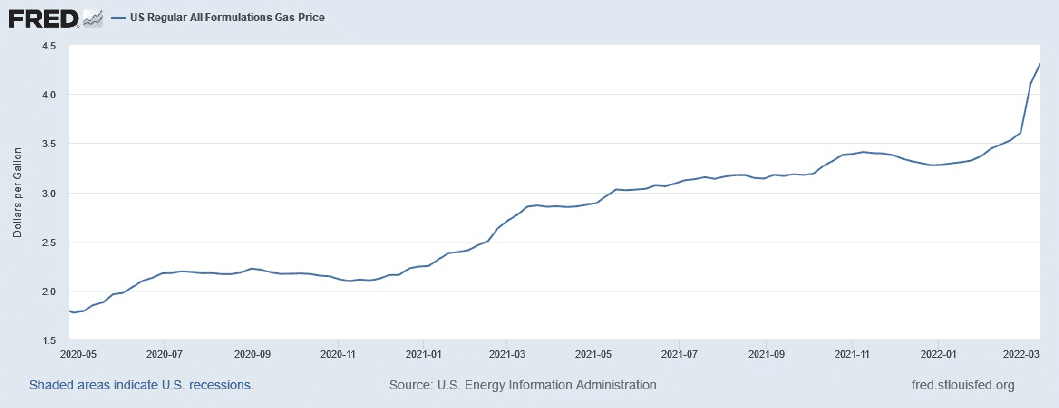

Rising Prices for Fuel and Grain Indicate Overall Inflation Problem

Since May 2020, the national average for a gallon of gasoline has risen by 143%, according to the Federal Reserve bank branch of St. Louis. In my opinion, food inflation will also likely be higher over the course of this year. The war in Ukraine has significantly disrupted supplies of natural gas. Natural gas is the most important component in the manufacturing of fertilizer. If you haven’t noticed, fertilizer is significantly higher over the last 12 months.

This is having an impact on grain growers across the world. The area of Ukraine and Russia being impacted by this war is responsible for growing a significant amount of the world’s wheat and grain.

I have to ask, to what degree might harvests and yields be lower later this year as a result of the war?

It would not surprise me to see a loaf of bread more than double in cost by the end of the year.

By the time you harvest what was planted, and that product is shipped to make flour, and then shipped to make bread, and then shipped to your favorite store, thanks to the rising cost of fuel and other factors, we could be looking at significantly higher food costs.

Finally, think of how grain touches livestock feed, and you can get a sense of how this inflationary force at a critical level could become much more worrisome over the coming months and quarters.

There have been suggestions from the general business media that families have healthy levels of cash savings. However, I believe there is much more to that story than what you are hearing from the administration. If households are swimming in excess reserves due to COVID-related stimulus spending, then someone explains to me why the average household is also currently swimming in debt.

Conflicting Stories on Consumer Savings Levels

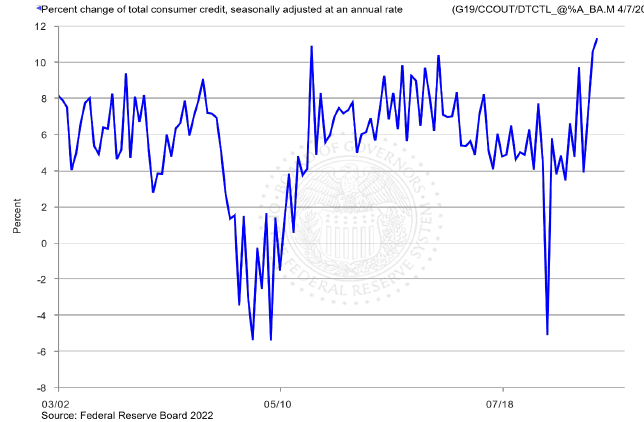

The graph above was sourced from the Federal Reserve Board on April 7, and it shows clearly that the percent change in total consumer credit is at a higher rate than we have measured since March 2002.

If the average household is swimming in cash, then why does it seem that credit cards are being maxed out to their limits? That doesn’t make sense to me. Personally, I believe that any excess cash that the average household once enjoyed has long since been usurped by increasingly higher costs of economically inelastic things such as food and fuel.

I have often said before that confident people spend money. When…….

- Income is high

- Inflation is low

- Taxes are low

- The velocity of money is normally higher

- Consumer confidence is also normally higher

During times such as these, spending on discretionary items is much stronger, and that is usually a hallmark of an expanding economy.

This graphic was sourced from the University of Michigan and reflects the most recent consumer confidence survey. The most recent reading is the third lowest that we have observed since the Great Recession. Tell me that you discern any optimism in that current trend.

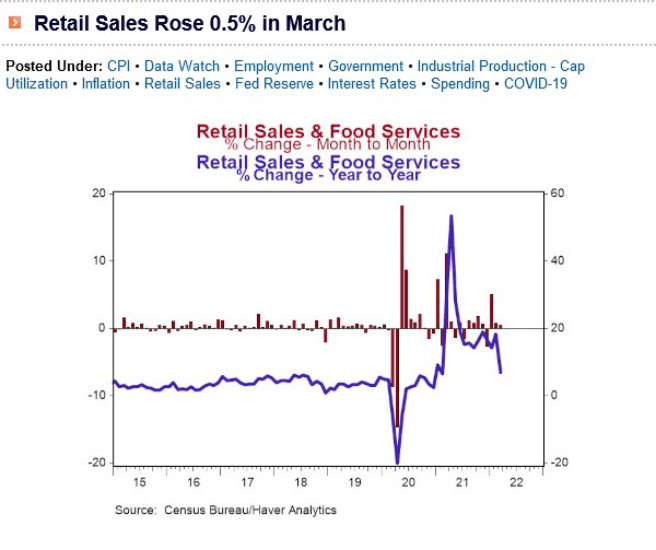

I believe that we can see this manifest in the most recent retail sales data as well. Retail sales depict our patterns of consumption and activity in terms of daily items.

In 13 of the last 15 months, we have seen retail sales declining. There is a theme in the general mass media suggesting that retail sales are positive year-over-year, and that is a valid point, but I would encourage you to try and show me anything reassuring in the pattern depicted in this graph over the last 15 months.

Yes, we can see significant changes in patterns of consumption in both of the ISM readings, durable goods, industrial production, new orders, factory orders, and retail sales. This overlaps perfectly with declining consumer confidence and worries over inflation at a time when wages do not seem to be keeping up with increases in the cost of living.

Despite Negative Economic News, Investment Opportunities Remain

We have talked before about remaining true to the plan that governs the execution of investment strategies. The strategy itself has not changed, but exposure to areas of the economy, and by extension, the investments within our portfolios, have.

As the economy ebbs and flows, there is always exposure that is appropriate for the time at hand.

Today, at a high level, I am encouraging people to overweight the stocks of companies that make things you will buy anyway. This would include:

- staples

- utilities

- pharmaceuticals

- precious and industrial metals

and other things that will likely sustain a period of economic softness more durably than other areas of economic exposure.

Clearly, this is overly simplistic, and obviously investment direction is individually tailored. Actionable advice can only be rendered following a comprehensive planning process. But the answer to the question is do not stop investing toward the achievement of a planned goal, but rather change the nature of those investments when appropriate, and when driven by economic changes. This is a marathon, not a sprint.

*David Guttery and Brandon Guttery offer products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA/SIPC – securities and investments | Ameritas Advisory Services (AAS) – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.