Now the dust has settled, it’s time to look back at the incredibly testing investment year that was 2022. The consensus among many seasoned financial advisors is: 2022 was the strangest year they’ve ever experienced. When conducting a 2022 market review, I realized the obscure nature of the year. We faced challenges we’d never encountered and influences outside of our control, reacting to market sentiment in completely different ways – we’ll come on to that.

However, from uncertainty and confusion emerges opportunity. And, as always, I’m excited about the year ahead. For this article, we’ll look back at 2022 and discuss its obscurities, as well as dive into some market predictions for 2023.

So, let’s jump right into it.

Click the video for additional footage on:

A Discussion of Markets & Economic Expectations for 2023

See how this video applies to you.

2022 Market Review & Investment Insight

As mentioned, 2022 was an odd year. I recently described myself as being shocked at the behavior of the market and the Federal Reserve. One thing that stood out about the year as a whole was market volatility. Granted, some volatility is expected, but this was different.

Personally, I believe the extreme volatility as we saw it was largely due to short-sightedness. Rather than looking at the bigger picture, toward a stabilized economy and future, many people, investors, and the Federal Reserve were shaken by the uncertainty of the economy and began taking a short-term approach.

We became reactionary rather than patient, and consequently increased market activity led to exceptional volatility.

The Federal Reserve Quantitative Tightening

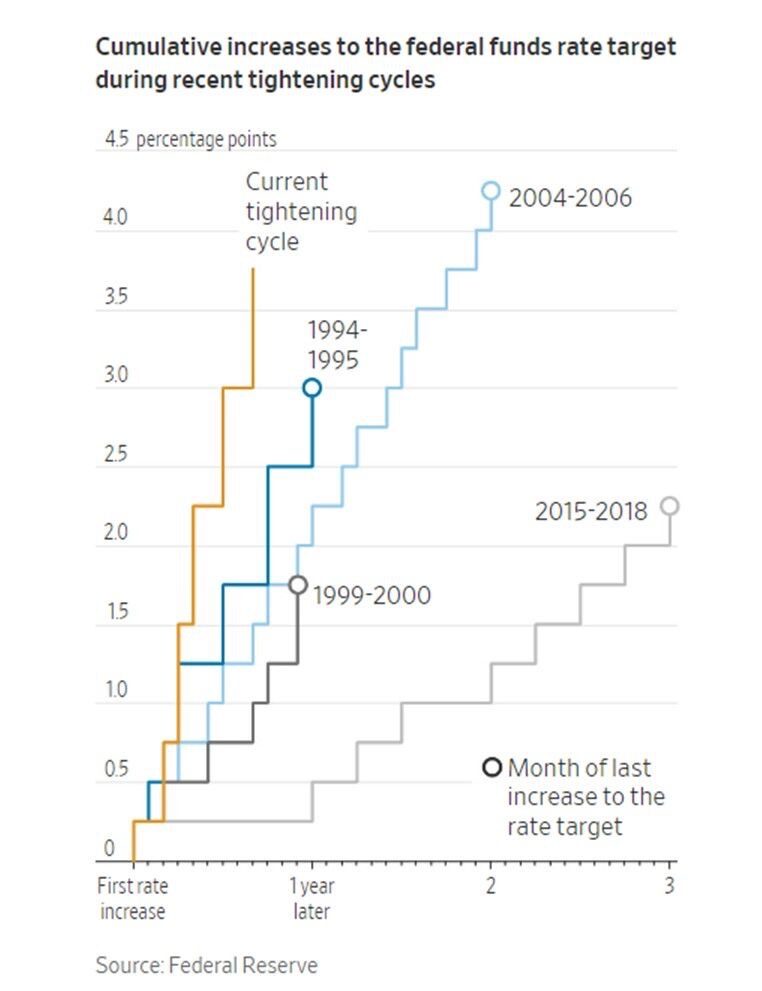

Back in January 2022, the Federal Reserve loosely alluded to tightening. In a non-committal, slightly confusing way, they let us know quantitative tightening might be on the way. When the fed rolled out its quantitative tightening strategy in March 2022, the market was shocked into short-term thinking.

Instead of applying quantitative tightening at the usual level we anticipated, the Federal Reserve initiated what turned out to be the most aggressive approach taken in over 35 years.

What Is Quantitative Tightening?

Quantitative tightening is a contractionary monetary policy tool used to normalize the balance sheet. Essentially, it is designed to reduce the level of activity within an economy by lowering the supply and liquidity.

One way the Federal Reserve undertook this was by selling off maturing bonds, amongst other things, with the aim is fighting inflation.

The Impact of Quantitative Tightening – Prices Dropped & Yields Rose

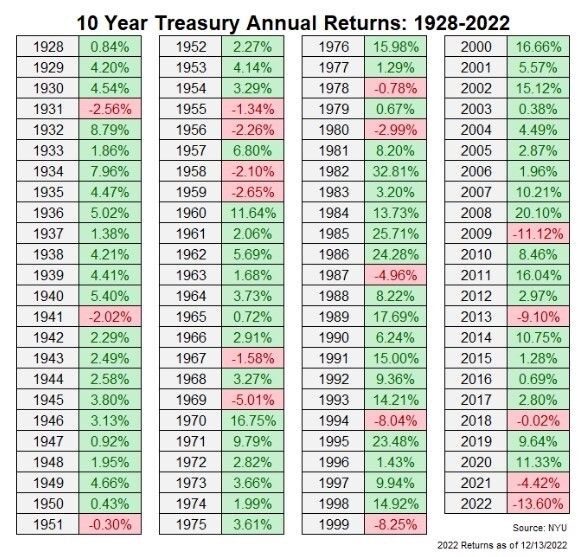

The drastic measure enacted by the Fed brought about a drastic reaction. Prices dropped sharply, with yields increasing exponentially. At this point, we saw a situation we hadn’t seen since 1981 – an inverted yield curve.

This unusual situation presented unique challenges. As prices tumbled, usually, we’d be looking toward fixed-term treasury bonds to keep our portfolios afloat. However, with quantitative tightening at play and with bonds and stocks positively correlated for the first time since 1972 – we couldn’t do this.

To contextualize, 2021 and 2022 marked the first recorded back-to-back losses for Treasuries since 1958, and it has only happened twice in over 70 years.

Quite unprecedented circumstances, I’m sure we can agree.

Your Dollar Was Worth More, But Goods Became More Expensive

By Q3 of 2022, the US dollar was seeing record highs against other basket currencies. Usually, this is great news. However, with inflation hitting consumers harder than any time since 1980, the strength of the dollar didn’t add any consumer buying power – another bizarre occurrence.

2022 Round-Up: An Eventful & Unprecedented Year

You get the picture by now. Our 2022 market review highlights what I believe to be a chain of events that each impacted the next. It was a domino effect, full of unprecedented occurrences.

Anecdotal evidence and experience are crucial in times of economic uncertainty. However, the challenges faced in 2022 were a build-up of the first, or at least a first in our lifetime. This presented a situation where we were facing a completely unique market.

However, there is a feeling of positivity headed into 2023, and I’m about to tell you why.

Market Predictions 2023: Stabilization

It’s early days, but there are signs that the market is starting to stabilize early in 2023.

For stabilization to occur, we need markets to reach the bottom. A useful tool for assessing if we’ve hit the bottom is capitulation.

In simple terms, capitulation is people cutting their losses. Essentially, this is reducing the average market participation. With fewer positions open, volatility should reduce, and a level of stabilization is introduced.

What Does Capitulation Look Like?

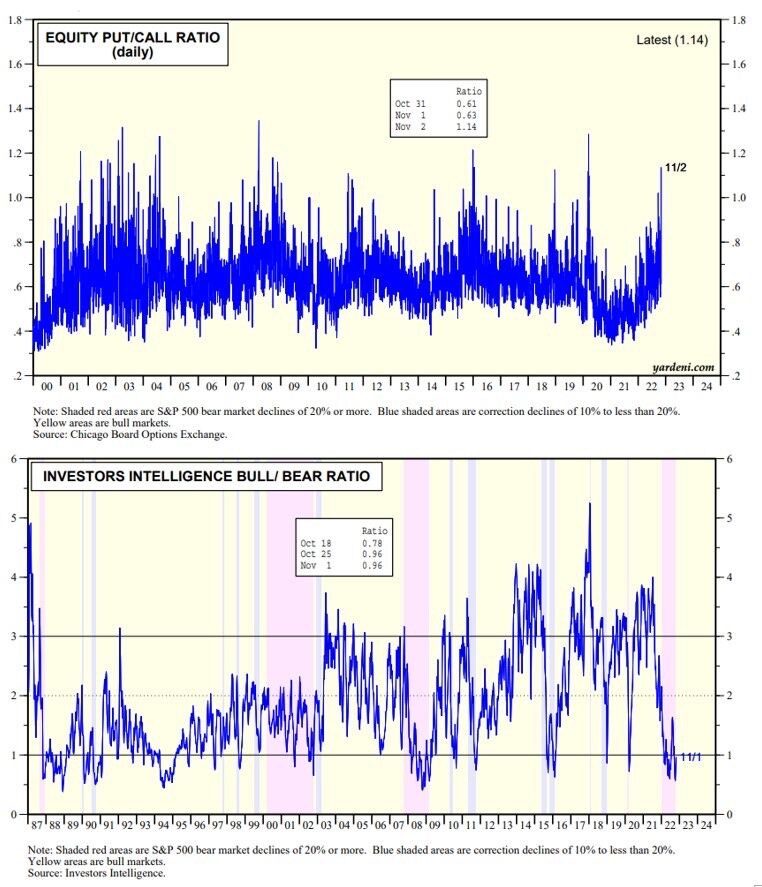

See these two charts on the right.

They first show what I believe capitulation looks like.

In September, we saw an extremely high ratio of open put options to open call options, peaking by the end of September; the highest indication of volatility that we had seen since COVID-19 caused the economy to shut down.

On the second chart, you’ll see bearish sentiment had not been this strong since September 2008, at the beginning of the great recession.

Does This Confirm We Have Reached The Bottom?

In a word: no. A single metric is not enough to confirm the bottom has been reached. We must crosscheck and make an assessment based on multiple analysis tools.

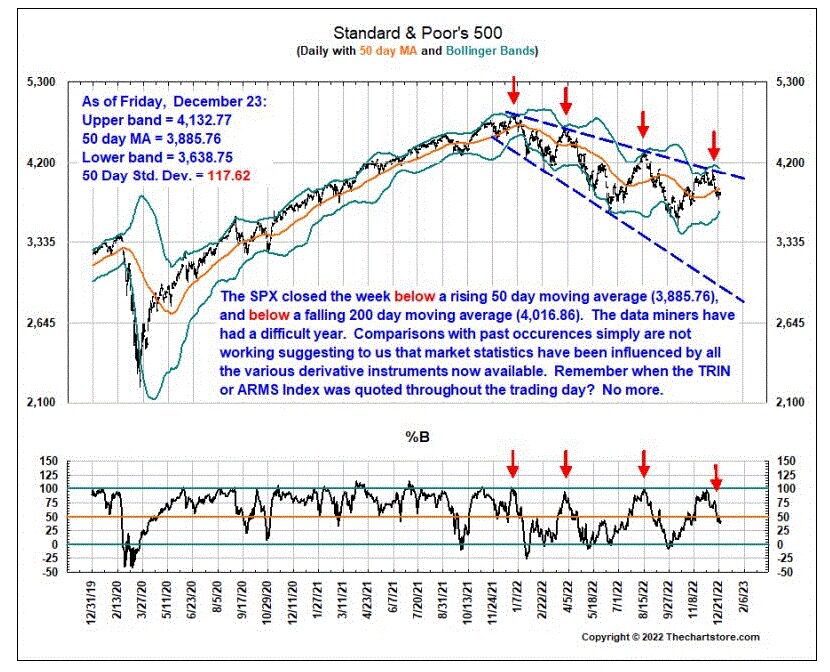

For our next market analysis we’ll use is Bollinger bands – a tried and trusted tool.

As we assess the chart below, it appears we’ve seen rejection at the same Bollinger band on four occasions last year, in February, May, July, and finally in September.

For anyone with basic chart analysis skills, you’ll know that a double, triple, or quadruple bottom is a sign of stabilization and reversal – these are encouraging and exciting signs for 2023.

Now, Has The Market Reached Its Bottom?

Taking into account market volatility, I believe that markets have found their bottom. We have anecdotal evidence and chart analysis to support this theory.

Sure, we should expect volatility to still be elevated during the first half of 2023 as bears will still be pushing for a more downward movement to break resistance, while bullish momentum needs to build to ensure upward movement.

However, this stability depends on the current and future actions of the Federal Reserve. If they deliver another shock, and the markets don’t build trust or find assurance, volatility will most likely continue.

Another positive sign is the fading strength of the dollar against other basket currencies. Since the November meeting of the Federal Reserve, USD has relinquished some of its overwhelming strength, meaning it becomes easier and more cost-effective for foreign businesses and investors to buy and sell in USD.

Market Prediction 2023: Will The Economy Improve?

In my opinion, markets may have bottomed, but the economy as a whole has not. This sounds negative, yet I trust the markets can recover incurred losses during the previous year, but we’re yet to find the bottom for the economy.

As mentioned, the short-sightedness of last year created a great deal of uncertainty. Many assumed we were destined for a long and deep recession – which has yet to materialize. So, in truth, the markets priced themselves into a position that most global bankers didn’t agree with – and still don’t.

We are destined for a recession – there’s little doubt about it. When the Nation Bureau of Economic Research confirms it, I expect to see a prolonged yet shallow recession, unlike the 2008 crash.

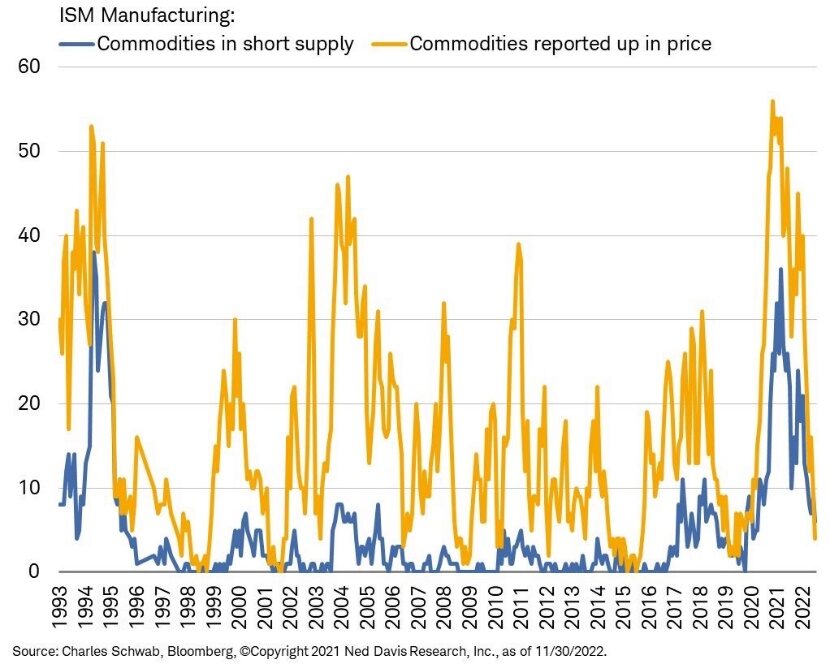

In terms of inflation, there are positive signs on the horizon. Respondents to the recent ISM Manufacturing Survey reported that the supply of commodities was becoming more plentiful, and their prices were dropping. If this trend continues, we should see prices begin to fall in the months to come.

We’re yet to see such results in markets for commodities that impact food, healthcare, fuel, and shelter. By their own admission, the Federal Reserve can do little to impact this.

Overall, we’re seeing positive signs for the economic landscape, but we will have to be patient. It will take time to see sharp positive changes, but we’re moving in the right direction.

In Conclusion: How To Invest In 2023

At a high level, I would suggest people remain more defensively invested in companies that manufacture products and deliver services that are durable in nature, rather than have overweighted positions in companies that produce discretionary things. As an example, invest in the companies that make toothpaste, shaving cream, ibuprofen, and food staples.

At this point, I would avoid the companies that make things you don’t necessarily need to have, a strategy that worked well last year and will continue to be of value as the new year unfolds.

As always, I suggest you remain focused on your overall financial planning objectives. During these ever-changing market conditions, it’s crucial to remain alert and ready to adapt. Currently, the market is very reactionary and is hanging off every word of the Federal Reserve.

Your portfolio should be fluid and active, based on the current market conditions, and your primary concern should always be your overall goals. Ask yourself – am I still moving positively towards my goals?

If you can take a step back with this holistic approach, it helps with the emotional management of a volatile market.

For more insights on 2023 market predictions or to discuss your financial planning goals – get in touch today.

*David R. Guttery, RFC, RFS, CAM, is a financial advisor and has been in practice for 31 years. He is the president of Keystone Financial Group in Trussville, Ala. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided here is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.