Today, I wanted to talk about life insurance for a minute, because, well, it is national life insurance awareness month, and I thought the timing was appropriate. Let me begin by saying that after the conclusion of this article, I hope you’re left with a greater understanding of the utilities that life insurance brings to a comprehensive plan for the management of wealth.

Today, I want to talk about what I call, the five utilities of life insurance. Most people think of life insurance as being only about a death benefit, but it’s much more than that. Sure, it’s a tax-free sum of money that a survivor can use to satisfy a mortgage, absolutely. When considering the death benefit utility of life insurance however, most people don’t consider how this can be a replacement of someone’s economic footprint. More on that in a minute.

Life insurance can also be a surrogate for traditional long term care insurance, and it can be used as a tax favorable silo for safe money. If funded properly, a stream of tax-free income can be generated from the policy at retirement, and lastly, depending upon the state within which you live, cash values can be protected against the claims of creditors. To some extent, most people have a need for one or a few of these utilities, if not all five, when we’re building a comprehensive approach to wealth management.

As a financial planner, I have an open architecture box of tools at my disposal. When was the last time you tackled a home improvement project with just one tool? I’ve never done that personally. Usually, we’re leveraging the utility of a hammer, saw, and plyers, as we’re working on the tasks at hand. If the task at hand calls for the driving of a nail, then I have a tool designed just for that purpose. Nothing wrong with the screwdriver. It’s just not going to help me drive a ten-penny nail.

Ok, you get the analogy. A product agnostic manager of wealth not only has a wide array of tools from which to choose, but also the knowledge and experience to know when to use what tool, and why. So, let’s talk about the life insurance hammer.

First, it’s a death benefit. That’s pretty straight forward. Sometimes, people enroll in their employer’s guaranteed standard issue term plan, and only elect coverage limits sufficient to indemnify a spouse from carrying a mortgage for example, or to fulfill a young child’s college plan. Its easy right? Payroll deduction premium, out of sight, out of mind, and so forth. Sometimes though, a person might find better rates after going through individual underwriting, rather than being one of a thousand people in a guaranteed standard risk pool. So, my first recommendation would be that before you sign up for such coverage at work, evaluate your individually held options first.

Second, think of the death benefit itself. It’s not just about satisfying a mortgage. What about your economic footprint. Consider a 45-year-old person with a $150,000 net household income. If that person dies, then ok, the spouse pays off the mortgage, but then what? If we had a death benefit of three million dollars, and at death, let’s assume that surviving spouse could invest those proceeds into a state specific double tax-free municipal bond issue at 5% hypothetically, then we’ve just replaced the $150,000 of net after tax income that was lost at the death of the spouse, correct?

Often, I’m asked if life insurance is something that should be taken into retirement. My mortgage is paid off and I have no debt, right? So, why do I need life insurance? Well, as part of my planning output, I’ve assumed that the two of you would fall off the edge of the commissioner’s table at the same time. What if that doesn’t happen? At the first death, the surviving spouse gets to keep the higher of the two streams of Social Security income, but you lose the lower of the two Social Security incomes. How do we solve for that?

Let’s assume that the lower of the Social Security streams of income was $25,000. Ok, well I need a half million death benefit policy, so that the survivor can potentially invest those proceeds into a state specific double tax-free municipal bond issue at a hypothetical 5% yield, to replace that $25,000 of durable, tax-free income. That’s replacing an economic footprint, and why life insurance should be a part of a multi-faceted retirement plan.

Beyond that, the second utility of life insurance is that hybrid policies serve two roles. It’s not just a death benefit, but also a surrogate for meeting potential long term care expenses. There are many structures from which to choose, but in general, if an insured is unable to perform two or more activities of daily living, a percentage of the death benefit becomes payable as a chronic illness benefit over a specified number of years.

It’s not a perfect alternative to traditional long-term care, but often, it can be easier to underwrite, and less costly. Furthermore, just because you’re unable to perform activities of daily living doesn’t necessarily mean that you’re receiving skilled nursing care in home, or confined to a facility, so, it can be easier to trigger a benefit from a hybrid life insurance policy as well.

At the beginning of this article, I mentioned that life insurance can be part of a retirement strategy, providing a silo of safe money, and a tax favored income. When I use the term safe, I’m drawing reference to a universal life, indexed universal life, or whole life type of policy, where values of cash are guaranteed by the strength of the insurance company and the solvency of its general account.

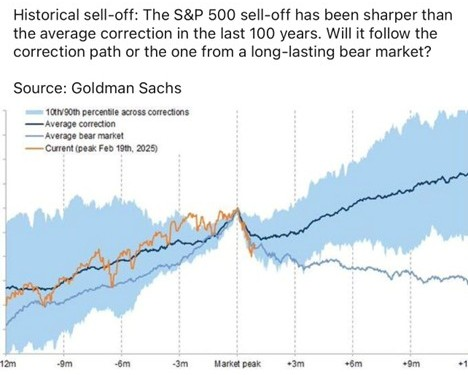

Within previous articles, we talked about how earlier this year, between the 20th of February, and the 20th of April, we experienced the fastest 21% drawdown in any rolling eight-week period of time in 100 years.

Well, because cash values within a universal life policy, an indexed universal life policy, or whole life policy, are guaranteed by the company issuing the policy, these values remained unchanged during this time of market upheaval.

Much like a 401(k), or an IRA, the government imposes limits on how much premium can be paid into a life insurance policy, because of the preferential tax treatment that is afforded to cash value accumulations within the policy. When funded properly, and to the maximum allowable threshold, a policy’s cash value can do much to dilute the holistic volatility of a client’s portfolios.

Said another way, I may have a client with a 401(k), and a brokerage account, and Roth IRA, and within those accounts, we’re pursuing growth targets and assuming risk. Well, if I have a well-funded, principally guaranteed tax shelter in this mix as well, then when I consider the entirety of all assets, the overall portfolio volatility drops if I have money allocated to a principally guaranteed platform like this.

As a retirement income tool, I’ve found that many people aren’t aware that it’s possible to take a tax-free income from the policy. This has been a common planning practice among those of higher nets worth for decades, particularly from within non-qualified deferred compensation plans. The good news is that anyone can leverage their permanent life insurance to accomplish the same thing. You don’t have to be a highly compensated, and restricted participant of a non-safe harbor 401(k) to employ this planning tactic.

At a high level, a client in this situation would pay premiums into their policy at a level just under TAMRA limits. TAMRA is an acronym that stands for the Technical and Miscellaneous Revenue Act. This and other restrictions came about in the early ‘80s in an effort to put limits on the amount of premium that could be paid into a cash value life insurance policy and continue to enjoy the tax preferential treatment of the accumulations under the tax code.

At retirement, a client begins to take withdrawals from the policy. These withdrawals are considered to be the distribution of the after-tax basis, or premiums paid into the policy. Once the basis has been disbursed, then a series of loans will be taken from the policy. At the death of the insured, all of the outstanding loans are satisfied by the tax-free death benefit. Well, when I’m 87 years of age, maybe I don’t need as much death benefit as I did when I was 45, but now I do need a Roth like stream of income. It is the unique favorable tax treatment afforded to life insurance that makes this happen.

One caveat, keep in mind that loans and withdrawals will lower the death benefit, and if excessive, could cause the policy to lapse, which is why it’s important to work with a competent financial planner when employing this strategy.

Lastly, life insurance can also provide protection against the claims of creditors. This varies by state. In the State of Alabama for example, I’m referencing Alabama Code Sections 6-10-8 and 27-14-29(b). An insured has an unlimited protection against the claims of creditors if the beneficiary of the policy is either the spouse, children, or dependents of the insured.

From a practical perspective, many of my clients of higher nets worth, and who might work in a highly litigious occupational field, have overly funded their life insurance policies for this reason. It provides another layer of protection against claims of creditors that may arise in the future.

For this utility, I would encourage you to consult with your legal professional to determine the exact extent of this protection that might be afforded within their state of residence.

So, there you have the five utilities of life insurance. It’s a tool. Just like a mutual fund, a stock or bond, an ETF, annuity, or any other financial instrument, it’s a tool. It brings a unique utility to the task at hand for which it was particularly designed. A hammer was designed to drive a nail. A screwdriver was designed to turn a screw. There’s nothing inherently wrong with either tool, but if the task at hand calls for the driving of a nail, then I’m going to leave the screwdriver in the tool box.

Life insurance is first and foremost about the death benefit, however it has the potential to be more than that. It can be used to replace durable streams of income, and replace the economic footprint of a deceased spouse. It can be a resource for meeting expenses of long-term care. It can be viewed as an integral part of your investment portfolio, as that of a principally guaranteed and tax-sheltered quasi bond holding. It can support tax favored income throughout retirement, and protect assets against the claims of creditors. Frankly, the list goes on. I could devote an entire article about how life insurance can be leveraged as part of estate planning for example.

I would just encourage you to not be satisfied with the quarter of a million-group term coverage at work. Critically assess your needs of insurance as part of a comprehensive plan for the management of wealth. Work with an advisor who can create that plan for you, and demonstrate how you might benefit from leveraging these utilities of insurance within that plan.

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 33 years, and is the Chief Executive Officer of Keystone Financial Group in Trussville, Alabama, and inSOURCE Financial Advisors in Lincoln, Nebraska. David offers products and services using the following business names: Keystone Financial Group and inSOURCE Financial Advisors – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group or inSOURCE Financial Advisors. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results. Examples are for illustrative purposes only and should not be considered representative of any investment. Investments involve risks, including loss of principal.