Recession Investment Goals: Secure Your Assets While Finding Income Opportunities

Are we in a recession? And if so, how should that knowledge impact your investment strategy?

Whether we are in a recession or not, it is important to note that every wealth management plan should be implemented with “guardrails” in place that are unique to the client. These guardrails address limits and tolerances for risk and codify such things as investment goals and the time with which we have to achieve those objectives.

There is no uniform, one-size-fits-all solution for investing through strange and unique times such as a recession. Whether we are in a recession or not, one universal truth still holds true, and that is that investment portfolios that are used to implement holistic wealth management plans should be individualized and reflect the unique characteristics of the client.

Click the video for additional footage on:

Strategies for Investing During a Recession.

See how this video applies to you.

Seasons Change – And So Do Investment Opportunities and Strategies

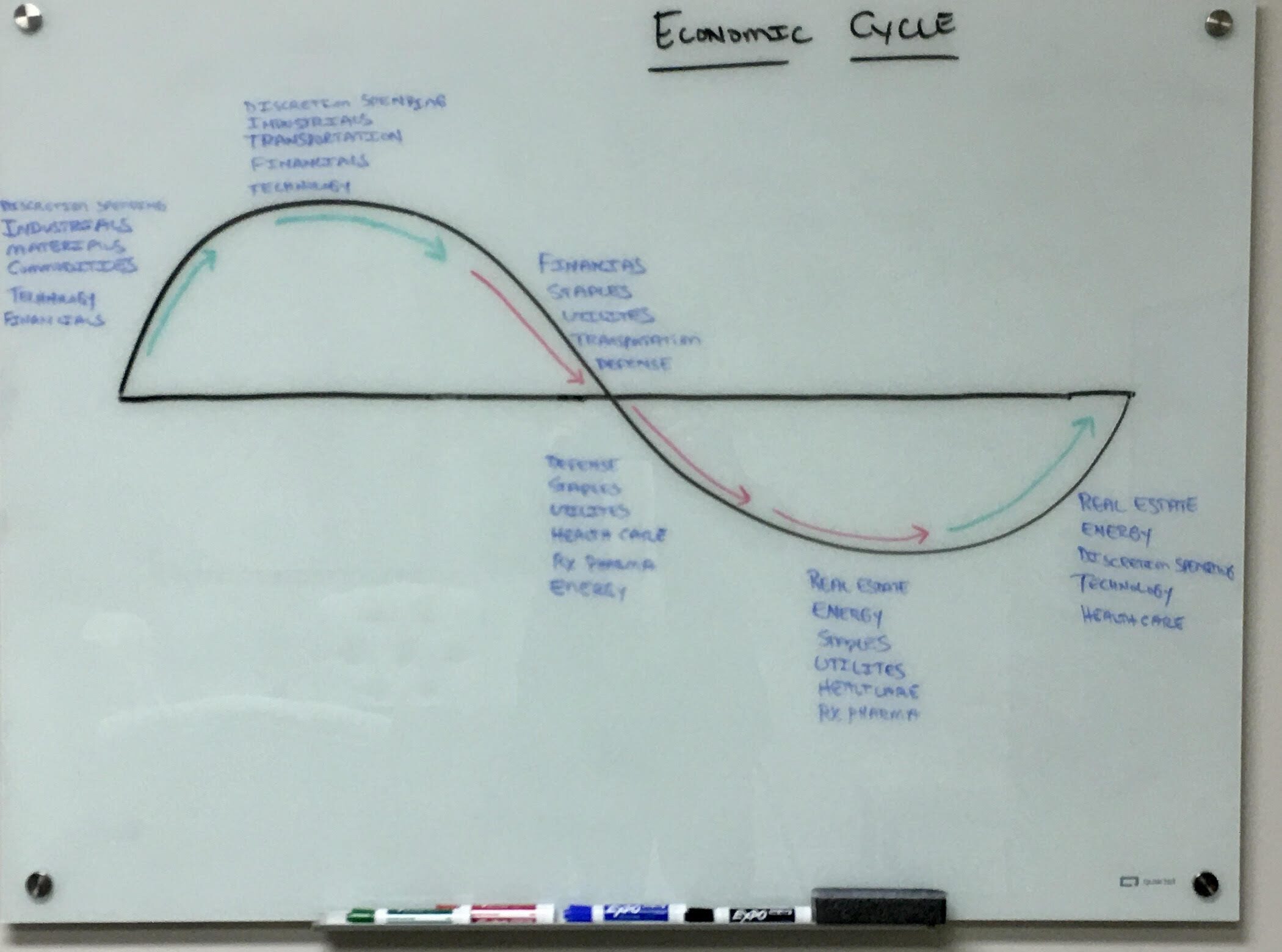

Think of investment patterns in terms of changing seasons. Imagine how your behavior is incentivized by what you feel.

As the seasons change from spring to summer, fall, and winter, and then back to spring, your clothing changes. During the summer, you wear short-sleeved shirts. During the winter, you wear jackets. Right now, in terms of the economy and investment opportunities, we are in the winter season of this cycle.

We can think of the jackets that we are wearing as consumer staples, utilities, healthcare, mega-cap pharmaceuticals, and energy providers. These are all durable areas of the economy. You will consume these products and services regardless of the state of the economy or your personal finances.

Just like your clothes, your investment portfolio should change from season to season.

The key to balancing your portfolio to match the economic season is understanding where we are in the economic cycle.

But to truly know how your portfolio should be balanced, a deeper analysis will need to be made.

Recession Investing: Balancing the 3 Investment Categories

At the present time, I would suggest that there is an equities part of this conversation, a fixed income part of this conversation, and an alternative part of this conversation. With the oddities that we observe in today’s economy, you really do need to think outside of the box, because historical anecdotes are of little value right now.

As for equities, this is what I call Warren Buffett thinking. Stop for just a moment and consider some very obvious things that are right in front of you.

Who is the manufacturer of your razor blades? What company makes your toothpaste? Who makes your favorite bar of soap, dishwashing detergent, and favorite beverage? Who are the companies that make the things that you purchase consistently? Of all of the things that you consume in a given month, which are the ones that you could not do without? These are what I call economically durable products and services.

Evidence suggests that 66% of American households are living paycheck to paycheck, and the personal savings rate is at a low level not seen since August 2009. In that kind of environment, I would suggest that discretionary things, items that you don’t necessarily need, will be the first things to be cut from household budgets, and we can expect the revenues and earnings of those companies to be lower during economic downturns.

In other words, avoid those companies when investing. Rather, focus on the companies that produce the things and services that you will consume durably.

Next, we must evaluate those companies in terms of financial health and strength. Which companies are trading at a low and attractive forward P/E ratio? Which companies are paying a higher dividend?

Keep in mind that it isn’t enough to identify the manufacturers of durable products and services — you must further screen those companies for health and position in their respective asset classes. Just because a company specializes in durable goods does not mean they are a good investment.

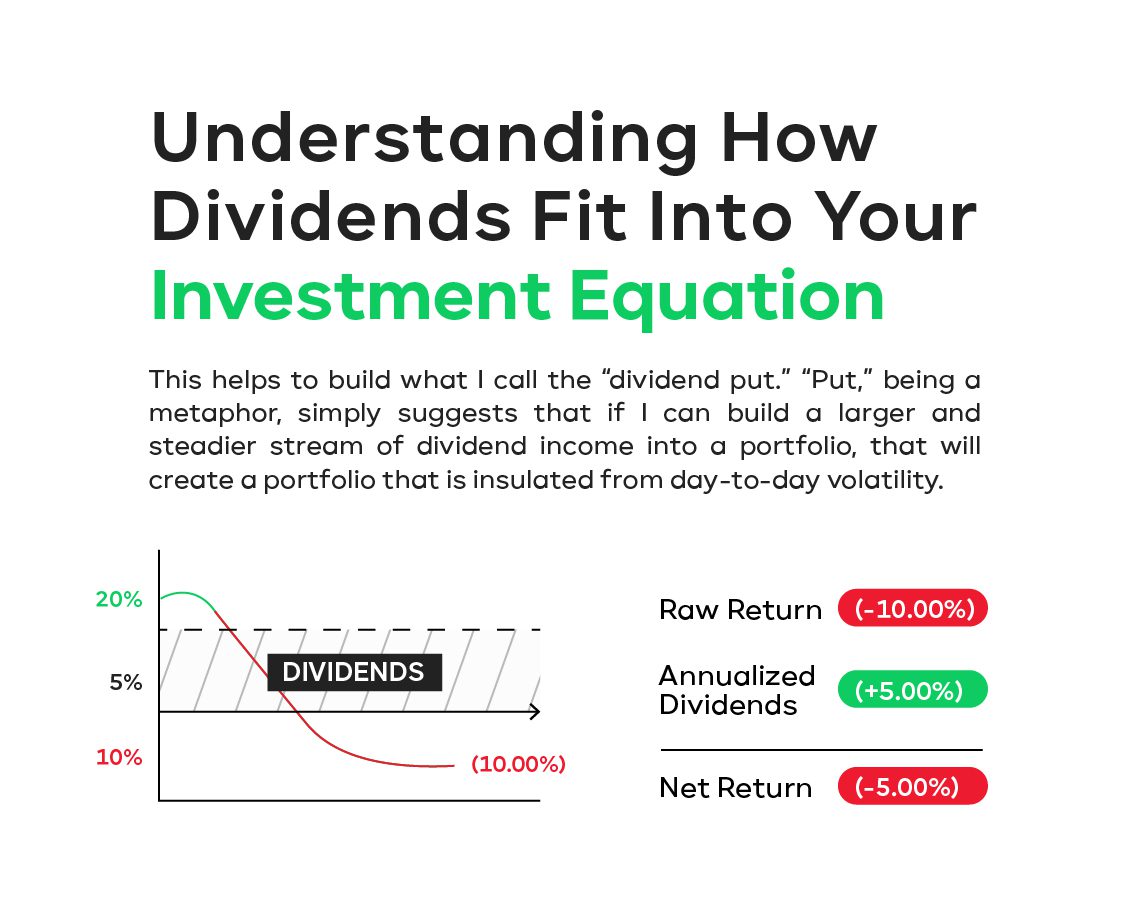

Understanding How Dividends Fit Into Your Investment Equation

This helps to build what I call the “dividend put.” “Put,” being a metaphor, simply suggests that if I can build a larger and steadier stream of dividend income into a portfolio, that will create a portfolio that is insulated from day-to-day volatility.

At a very high level, I have encouraged clients to think of it this way: If your overall return reflects a loss of 10%, but the things that you own to return a 5% dividend yield over the coming 12 months, then in my mind, you are down net 5%.

The construction of the dividend put is a very real way to offset the volatility of a recession. Those dividends can be constructed by using the stocks of companies that produce things that you are consuming durably. Those products and services will be among the last things to be cut from a budget during a recession.

It also is good practice to pay attention to the actions that corporations are taking today. Metrics regarding labor costs and worker productivity are very caustic right now.

There is ample evidence that corporations are trying to become leaner in this environment, not bigger. The most recent reading on second-quarter annualized labor costs showed an increase of 10.8%, while worker productivity declined by 4.6%. We saw similar metrics in the first quarter as well.

So, what observable evidence do we have that corporations are attempting to become leaner in this environment? We have heard from process automation technology companies as well as information management companies that revenues are being driven by enterprise-level pricing as companies attempt to streamline their automated industrial processes and the efficiency with which data are managed, in an effort to employ fewer people and replace the human element with automated processes. So, from a strategic hold standpoint, it would make sense to have narrowly focused holdings in such equities while also maintaining large, nebulous footprints in the staples, utilities, pharmaceuticals, and other durable companies.

Fixed Income: Your Defense Against Market Volatility

Now, as for fixed income, I believe that every portfolio, regardless of the objective, and time, should have a component of fixed interest. Normally, this provides a negative correlation against volatility as well as buoyancy through the inclusion of bond yield into the portfolio.

As we said, this is a very strange period of time that we are in. Treasuries and equities are positively correlated for the first time since 1972. Clearly, that was a very long time ago. Being positively correlated means they are moving in the same direction.

The two-year vs. the ten-year treasury yield curve is inverted to a degree not seen since the year 2000. An inverted yield curve simply means that you have prices that are going down, as evidenced by rising yields.

There is a myriad of reasons for this, but at a very high level it mainly comes down to there being a glut of U.S. Treasury debt on the global market. This is an important observation because we are not able to achieve a negative correlation with market volatility by holding treasury securities that have historically given a buoyancy to portfolios during times such as these.

So, what do we do about it?

At this time, we are focusing heavily on fixed-income instruments that are issued by the same corporations that I mentioned in the equities part of this discussion. The health of these companies is critical when you’re considering their fixed income issues. Furthermore, we seek to hold maturities of less than five years, with single- or double-A credit quality, or better, in an effort to minimize the duration and maximize yield in the portfolio.

This does not offer a guarantee against negative price movement, but so far this year, it has certainly been less pronounced than what we have seen from the treasury complex.

Alternative Investments: More Useful Tools for Stability and Income

Finally, we must consider alternative investments. “Alternative,” as the name implies, means something outside of the normal and customary group of standard investment tools. These can be real estate investment trusts, unit investment trusts, or limited partnerships, and they can also include such things as structured notes and market-linked CDs.

Often, these alternative investments are limited to accredited investors because of their complexity. However, in certain situations, they can be useful tools for achieving negative correlation and for the income that we are seeking at this time.

Having said that, I would also suggest that there are some very obvious tools that I would include in this category that is often overlooked but could nonetheless be very useful.

For example, the products of insurance companies, including but not limited to equity-indexed annuities and cash value building life insurance, can be viewed as an external complement to what we may maintain as a sleeve of fixed income securities in a brokerage account.

With universal life insurance, for example, we have attributes including the guarantee of principle, the tax-sheltered aspects of life insurance, and a fixed interest rate that is often higher than what you can find with traditional fixed-interest products and is on par with the yield that could otherwise be generated from a sleeve of bond investments.

So again, you really have to think outside of the box in an environment like this. The yield curve is more steeply inverted than at any other point over the last 20 years. The dollar is on the verge of setting a new all-time record high against the global basket of currencies.

Treasuries are positively correlated with equities for the first time in 50 years. The University of Michigan consumer sentiment survey is at an all-time record low. The Goldman Sachs housing affordability index is at a level that we haven’t seen since the early 1990s. And because of the strength of the dollar, gold is also positively correlated with inflation.

If you’re reading this, then I would strongly encourage you to work diligently with your source of holistic wealth management and think outside the box to find solutions that will produce favorable investment results during such a strange period of time.

In closing, let me just remind you about the economic season cycle that we referenced at the beginning of this article. In terms of clothes that you wear during changing seasons, there is always something to wear. In some cases, what clothing you choose is pretty obvious, but in a difficult period of time like this, you really must think outside of the box for creative ways to find warmth when it suddenly gets cold.

*David R. Guttery, RFC, RFS, CAM, is a financial advisor and has been in practice for 31 years. He is the president of Keystone Financial Group in Trussville, Ala. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided here is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.