Recently, inflation and Federal Reserve policy have drastically impacted the markets and the economy. After a turbulent and short-sighted 2022, it appears there are some reasons for optimism coming into 2023.

There are many positive signs and green shoots, pointing toward what could be a better scenario than many anticipated.

Click the video for additional footage on:

Green Shoots & Their Potential Impact on 2023

See how this video applies to you.

The Current Economic Outlook Is Much Like Growing Tomatoes

This might sound ridiculous, but hear me out, and you’ll understand why the current economic outlook is much like growing tomatoes.

Any gardeners out there will know that before you can harvest your crop, you have to endure the growth cycle. In the early tomato season, yellow blooms give way to tiny green balls. These green balls are a sign of optimism that the crop will turn out well.

However, weather conditions for the remainder of the season need to be in our favor. It’s not quite a time to make salsa yet, but we’re on our way there.

But how is this relevant to the 2023 economic outlook?

Well, it looks like we’re seeing some stabilization in market conditions, and market segments are demonstrating encouraging patterns.

Do you see? These are our green balls!

What about the weather ahead? There are no ripe tomatoes without the weather. Much like the actual weather, we can’t 100% predict what will happen.

However, from an economic and financial standpoint, we’re looking toward the Federal Reserve for our forecast. If the policy and message delivery remain positive, there’s much hope these green balls will be juicy tomatoes soon enough.

The 10 Leading Economic Indicators

Still with me? Let’s drill down into these green shoots. What are they, and why do they present optimistic stock market predictions?

The 10 leading economic indicators help us assess the future of the economic and market activity. You may be familiar with other indicators, such as GDP. These show where the economy has been, but we’re interested in looking forward.

Throughout 2022, many predicted a deep and prolonged recession. The shock of the Federal Reserve unveiling its most aggressive schedule of tightening in 35 years sent markets wild. However, if we look at the market analysis and leading economic indicators today, it paints a different picture.

Yes, the recession will be long, but it appears it will be shallow and won’t reach the depths of the 2008 crash. That’s good news – we have a green shoot here, as markets predicted a recession much worse than we’re actually experiencing.

However, for market participants to react and reprice risk positively, these green shoots will need to continue, and the economy only being slightly recessed is crucial to this.

Still with me? Let’s drill down into these green shoots. What are they, and why do they present optimistic stock market predictions?

The 10 leading economic indicators help us assess the future of the economic and market activity. You may be familiar with other indicators, such as GDP. These show where the economy has been, but we’re interested in looking forward.

Throughout 2022, many predicted a deep and prolonged recession. The shock of the Federal Reserve unveiling its most aggressive schedule of tightening in 35 years sent markets wild. However, if we look at the market analysis and leading economic indicators today, it paints a different picture.

Yes, the recession will be long, but it appears it will be shallow and won’t reach the depths of the 2008 crash. That’s good news – we have a green shoot here, as markets predicted a recession much worse than we’re actually experiencing.

However, for market participants to react and reprice risk positively, these green shoots will need to continue, and the economy only being slightly recessed is crucial to this.

(1) The Financial Conditions Index

For another green shoot in our positive economic outlook, let’s examine the financial conditions index from the Chicago Federal Reserve.

At present, it indicates that conditions continue to improve.

Put simply, if the line on the chart is going down, it’s a good thing.

You can see on the far left of the chart the period of time when COVID significantly impacted financial conditions. Interestingly, that line seems to be in the same area as it was in March 2022, when the Fed began this aggressive schedule of tightening.

For another green shoot in our positive economic outlook, let’s examine the financial conditions index from the Chicago Federal Reserve.

At present, it indicates that conditions continue to improve.

Put simply, if the line on the chart is going down, it’s a good thing.

You can see on the far left of the chart the period of time when COVID significantly impacted financial conditions. Interestingly, that line seems to be in the same area as it was in March 2022, when the Fed began this aggressive schedule of tightening.

(2) Positive Signs For Inflation

Another positive is inflation appears to be moving in the right direction. Yes, it’s still much higher than the average rate we’re used to and remains higher than Federal Reserve targets, but we can be positive that it is moving lower.

In November 2022, the Federal Reserve policy announcement said decisions would be driven by current data rather than the hawkish approach of earlier in the year. There are no signs of the end of tightening, but suggestions it will slow down.

However, for expected inflation in 2023 to remain positive, market participants need to trust that the Federal Reserve will maintain its stance. Since the initial November announcement, the Federal Reserve Board and Federal Open Market Committee have reiterated the message.

(3) Shelter

The shelter is a major component of the consumer price index and has stubbornly driven elevated levels over previous months. However, we can see another green shoot appearing. Rent Equivalents – a proxy for the shelter component in the CPI index, is also moving down noticeably. If this continues, then it should translate into future, increasingly favorable inflation readings.

(4) Supply & Prices of Commodities Improving

According to the Institute of Supply Management, commodities that were previously short in supply and high in price appear to be declining significantly. This indicates supply improvements and more favorable prices.

Here we have yet another sign that the 2023 economic outlook can be positive.

(5) It’s Not All Green Shoots & Challenges Remain Ahead

Unfortunately, the majority of inflationary pressures remain at the food, fuel, energy, and healthcare level. These are beyond the control of the Federal Reserve because a simple rate hike won’t have the same impact.

There is more work to do concerning controlling inflation, but there are positive signs. Thanks to this positive movement, the Fed will likely remain committed to the stance they outlined in November 2022.

It looks like Federal Reserve policy will focus on creating an environment with fewer dollars in circulation, where people and institutions are spending less. Additionally, they’ll continue to unwind their balance sheet and drain lendable reserves from the system. However, and importantly, this will happen at a slower pace than last year and possibly even slower than markets anticipate.

(6) The S&P 500 Could Be Set For A Swing In The Right Direction

It’s too early to predict a trend in the equity and fixed-income markets, but it appears volatility is beginning to subside. However, this trend needs to develop over time to predict with any certainty.

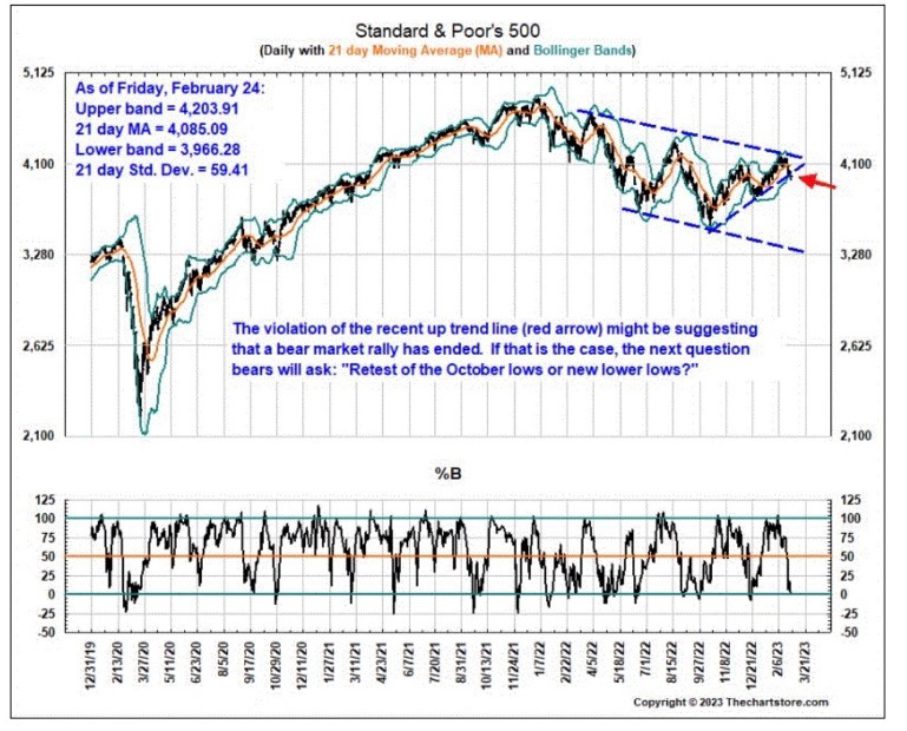

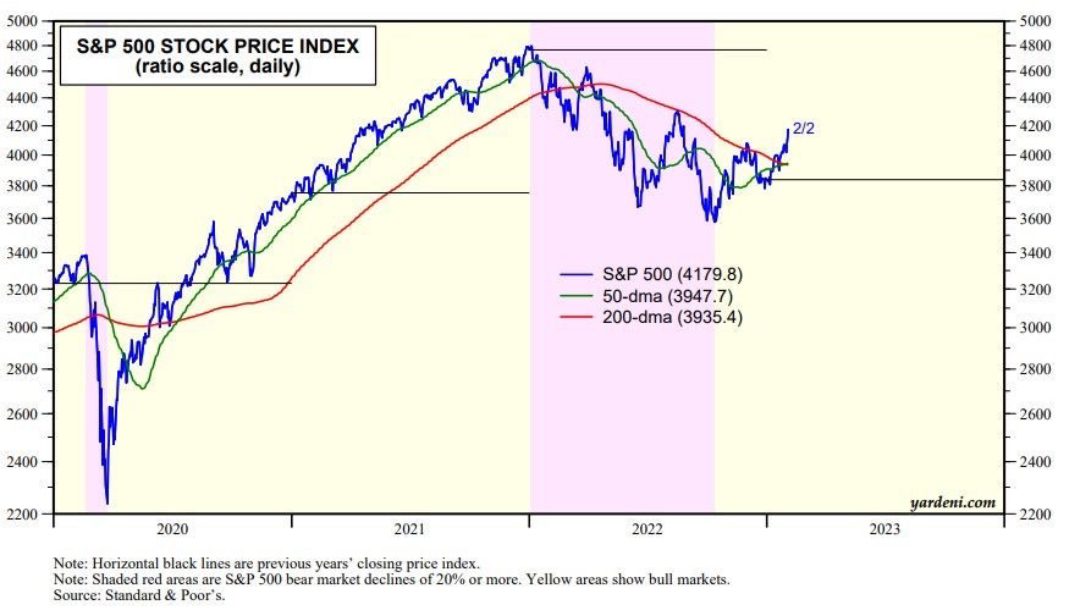

As mentioned, markets became very reactionary in 2022, looking no further than 30 days until the next Federal Reserve meeting. However, this is beginning to change. Taking a look at S&P 500 technical analysis, it looks like a trend of higher lows and higher highs could be forming.

Additionally, as the price approaches a historical resistance level, we need to be watchful for momentum. If it manages to break through resistance, will it have enough backing to make a significant breakthrough?

Moving average is another heavily used and highly trusted technical analysis indicator. Recently, the S&P 500 crossed both the 50-day and 200-day moving averages. This happening so early in a potential reversal supports the theory that there will be enough momentum for a breakout.

(7) Market Segments with Positive Signs

Again there’s no certainty here, but we can take a look at some market segments and find encouraging signs.

Analysis of the financial sector suggests we are indeed staging a breakout. Even though the Fed is draining lendable reserves, bond yields are seemingly favorable to diversified financials – yet another positive sign.

Furthermore, a quick look at Industrials shows encouraging signs too. With a reversal pattern presenting a potential breakthrough of long-term resistance.

(8) Stock Market Predictions Based On Analysis

The S&P 500, along with the financial sector and industrials, suggest that markets could be warming up and beginning to trust the Federal Reserve will maintain true to its policy direction.

This will take time to unfold, and the key will be consistent messaging and action from the Federal Reserve over the coming months and quarters. But for now, there are encouraging signs that market conditions may be changing

(9) How Will The Federal Reserve Policy Change?

Realistically, it doesn’t look like the Federal Reserve will begin cutting rates anytime soon. Nor does it appear a subsequent round of quantitative easing will materialize. Their balance sheet is still bloated, and an approach similar to what was outlined in November 2022 looks set to continue.

Some business media sources suggest the Fed could potentially reverse course and begin adding to its balance sheet. Yes, this will have to happen in the future, but for 2023 economic predictions, this seems unlikely.

The fact that some sources believe this shows that market expectations still don’t fully align with the Fed. This further illustrates that the Federal Reserve needs to remain steady in pursuing its stated objective, allowing market participants to regain confidence and trust.

(10) Will The Markets React Positively To Federal Reserve Policy?

Will there be signs markets are becoming comfortable with the thought that the Federal Reserve won’t shock the markets again?

That time has to come at some point, and it will be when we start receiving the good news that remains good news.

As an example of the current uncertainty, recently, the Labor Department announced a good but hotter-than-expected reading.

The good news is that more jobs were created than the market expected. However, this led to some bad news, with markets then anticipating a significant shift in Federal Reserve policy in an effort to pour cold water on that development.

Do you see the disparity and second-guessing the market is currently doing when trying to anticipate Federal Reserve policy?

However, as The Federal Reserve is trying to avoid stagflation, the economy has to be moving forward. So, as long as the financial conditions index continues to move in the right direction and metrics of inflation continue to improve, then it’s unlikely the Federal Reserve will significantly change its policy stance over one or a few hotter-than-expected economic reports.

2023 Economic Predictions & Market Conditions

Overall, its anticipated volatility will remain above average for at least the first half of 2023. However, if the trends outlined above continue to unfold, volatility could return to normal levels. This will be down to markets becoming increasingly encouraged to reprice risk positively.

We’re seeing green shoots, and there will be more to come. However, these positive signs shouldn’t sway our vigilance to risk. Like the tomato season, many factors will determine the harvest.

After all, and for want of a better cliche, this is a marathon, not a sprint. We’re a long way from the finish line and won’t be out of this uncertainty tomorrow, next week, or next month.

To discuss actively managing your portfolio during this time, get in touch with our experts today.

*David R. Guttery, RFC, RFS, CAM, is a financial advisor and has been in practice for 31 years. He is the president of Keystone Financial Group in Trussville, Ala. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided here is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.